In 2012, Pershing Square’s Bill Ackman initiated a $1 billion short bet against weight-loss and vitamin multi-level marketing company Herbalife (NYSE:HLF). After a protracted battle with activist investor Carl Icahn, he unwound his position in 2018. Yet, revenues have plummeted over the past five years, and the stock has cascaded down over -80%. The company is now restructuring its organization, and recent earnings exceeded expectations, suggesting those efforts may bear fruit.

The stock trades at a deep discount, though investors might want to wait for further confirmation of a turnaround before taking a position.

Herbalife is Undergoing a Comprehensive Restructuring

Herbalife is a company known for its weight management, supplements, and sports nutrition products, distributed through a direct-selling multi-level marketing model. It operates in over 90 global markets and has over 2 million “Independent Distributors.”

Despite criticism from short sellers, regulators, and ex-employees, the company maintains its infamous marketing approach, including allegations of a pyramid scheme that have emerged over the years.

As mentioned above, the company is undergoing a comprehensive internal restructuring to improve efficiency and productivity. Parallel to this change, the company leadership team is evolving by adding new Board Members, a new Chief Financial Officer, and a new Chief Operating Officer.

The company has given guidance that most of the restructuring will be completed by the end of June, and they expect it will result in approximately $40 million in savings in 2024 and roughly $80 million in annual savings beginning in 2025.

Herbalife’s Recent Financial Results & Outlook

Herbalife recently released its first-quarter financial figures, showing a revenue of $1.3 billion that exceeded expectations by $30 million. Net income was $24.3 million, driving non-GAAP EPS of $0.49, which was also a sound beat of consensus expectations for $0.35.

During the quarter, the company reduced debt by $155 million and finished with nearly $400 million in cash on the balance sheet. Further, a $1.6 billion senior secured refinancing was completed, lowering the total leverage ratio to 3.6x from the year-end figure of 3.9x while pushing out debt maturities to 2029.

Management’s projections for operational cash flow for the rest of 2024 range from $250 million to $290 million. These estimates take into account an expected expenditure of about $60 million on the restructuring program and the increased interest expense stemming from recent financing activities.

What is the Price Target for HLF Stock?

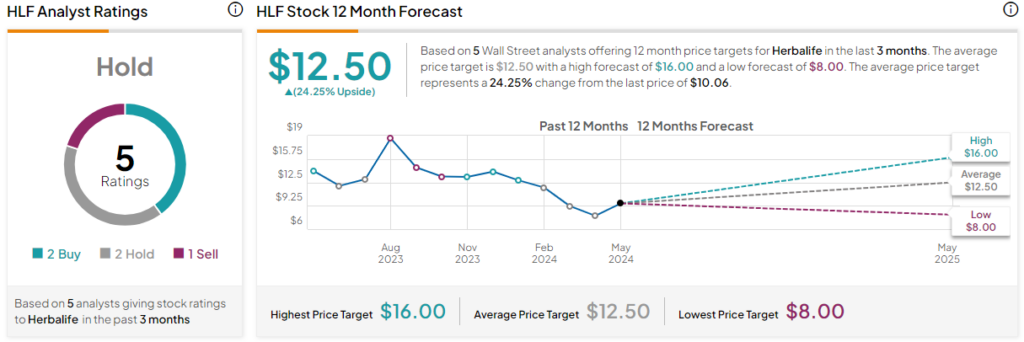

Herbalife is rated a Hold based on five Wall Street analysts’ recommendations and price targets over the past three months. The average price target for HLF stock is $12.50, representing a 24.25% change from current levels.

The analysts following the company have mixed opinions on the stock, with many lowering their near-term expectations. Mizuho Securities analyst John Baumgartner recently dropped the price target on Herbalife from $12 to $10 while keeping a Neutral rating on the shares. He noted the recent restructuring was positive but is looking for signs of a more substantial revenue recovery to regain confidence in the company’s potential growth.

The stock has been trending upward, climbing over 23% in the past month. It demonstrates positive price momentum, trading above the 20-day (8.58) and 50-day (9.34) moving averages. It is currently trading at a deep relative discount, with a P/E ratio of 7.3x, significantly lower than the Consumer Defensive sector average of 22.8x and the Packaged Foods industry average of 19.25x.

Final Analysis on HLF Stock

Herbalife has a colorful history that is ripe for a Hollywood movie. The ride has been a horror show for the past few years. However, recent signs point to a potential turnaround. While the stock shows positive momentum and appears to be relatively undervalued, it’s still early to determine if its past mistakes are long gone or if the skepticism shown in the market is justified. Investors may want to wait and gather more data points to confirm the positive results of the restructuring have indeed taken hold and given the company new life.

Questions or Comments about the article? Write to editor@tipranks.com