Heico Corporation (HEI), a provider of aerospace and electronics products and services, delivered mixed third-quarter results with earnings beating and revenue missing consensus estimates.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company is witnessing a steady rebound in commercial aerospace market conditions, which were impacted by the COVID-19 pandemic last year. Shares fell as much as 3.8% in the extended trading session following the news on August 24. (See Heico stock charts on TipRanks)

Heico reported quarterly earnings of $0.56 per share, up 40% year-over-year, and marginally surpassing the Street’s estimate of $0.54 per share.

Meanwhile, net sales climbed 22% to $471.71 million compared to the year-ago period but fell short of analysts’ estimates of $485.1 million.

The increase in sales was primarily driven by the growing demand for Heico’s commercial aerospace products across all product lines in its Flight Support Group due to the recovery in global commercial air travel.

Moreover, its Electronic Technologies Group witnessed strong organic growth in revenue backed by demand for its other electronic, defense, medical, and commercial aerospace products.

Commenting on the solid results, Laurans A. Mendelson, the company’s Chairman, and CEO said, “We are very pleased to report much improved quarterly operating results within both Flight Support and Electronic Technologies…Our performance principally reflects quarterly consolidated organic net sales growth of 17% and the favorable impact from our fiscal 2020 and 2021 acquisitions.”

In response to the mixed results, Cowen & Co. analyst Gautam Khanna maintained a Hold rating on the stock with a price target of $120 (7.8% downside potential).

Khanna noted that Heico’s lower taxes drove the marginal beat in its earnings compared to the consensus. Additionally, he mentioned that the modest 3% sequential growth in Flight Support Group sales was lower compared to the 16% sequential growth witnessed in the second quarter.

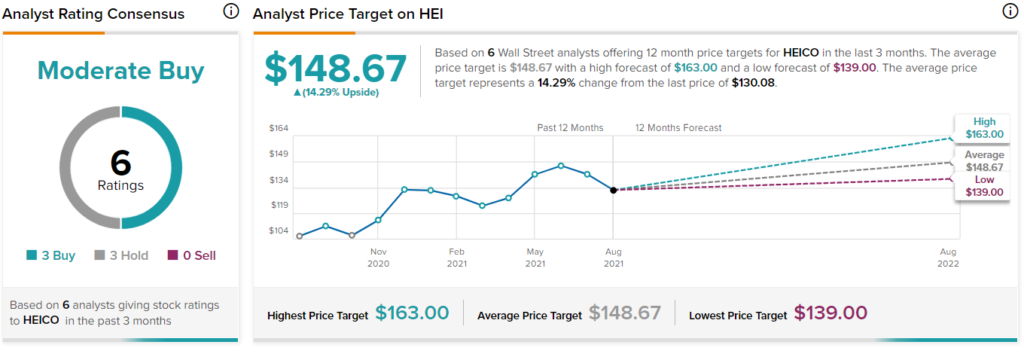

Overall, the stock has a Moderate Buy consensus rating based on 3 Buys and 3 Holds. The average Heico price target of $148.67 implies 14.3% upside potential to current levels. Shares have gained 17.9% over the past year.

Related News:

Urban Outfitters Dips 5% After-Hours Despite Exceeding Q2 Expectations

Palo Alto Soars 10% on Robust Q4 Results & Upbeat FY22 Guidance

Scientific Games Snaps Up Sideplay Entertainment; Shares Pop 4%