The truckload carriers market experienced a significant downturn in 2023, as overcapacity, a substantial drop in spot rates, and inflation eroding profits hit the industry hard. Heartland Express’ (NASDAQ:HTLD) is fighting through this freight recession, with the stock down over 32% in the past year.

However, despite the challenges, Heartland could represent a potential opportunity as there are signs the trucking industry could be on the road to recovery. Investors may want to track the company in order to participate in the potential upside.

Heartland Navigates a Tough Environment

Heartland Express is a holding company that provides short-to-medium haul truckload carrier services and long-haul and regional truckload transportation. As a leader in transportation and logistics, the company is recognized for its punctual pickup and delivery, scalable fleet capacity, and ability to establish strategic relationships with clients, among other attributes.

Post-pandemic, demand for freight capacity skyrocketed, driving prices higher and eventually attracting enough new drivers and trucks that long-haul capacity roughly doubled. Yet, as freight demand waned in 2023, this massive build-up of capacity drove prices down, leaving national carriers grappling with increased costs, surplus truck capacity, reduced freight demand, and decreased freight rates.

While the market has yet to show signs of a rebound, industry experts suggest conditions are stabilizing. Rates are trending toward more normal levels, and recovery may be on the horizon in late 2024 or early 2025.

Heartland’s Recent Financial Results

Heartland recently reported its Q1 earnings, showing a revenue drop of 18% year over year to $270 million, reflecting a 2% decrease from the fourth quarter. The company reported a net loss of $15.1 million, translating to a loss of -$0.19 per share, which was $0.07 worse than consensus estimates and down $0.35 year over year. This marks the company’s third consecutive net loss, excluding one-time gains from the sale of properties.

Heartland Express’s Board of Directors maintained its regular quarterly cash dividend despite financial setbacks, with a dividend of $0.02 per share. This payment represents the company’s eighty-third consecutive quarterly cash dividend, totaling $550.5 million in cash dividends since it started the program in 2003.

What is the Price Target for HTLD Stock?

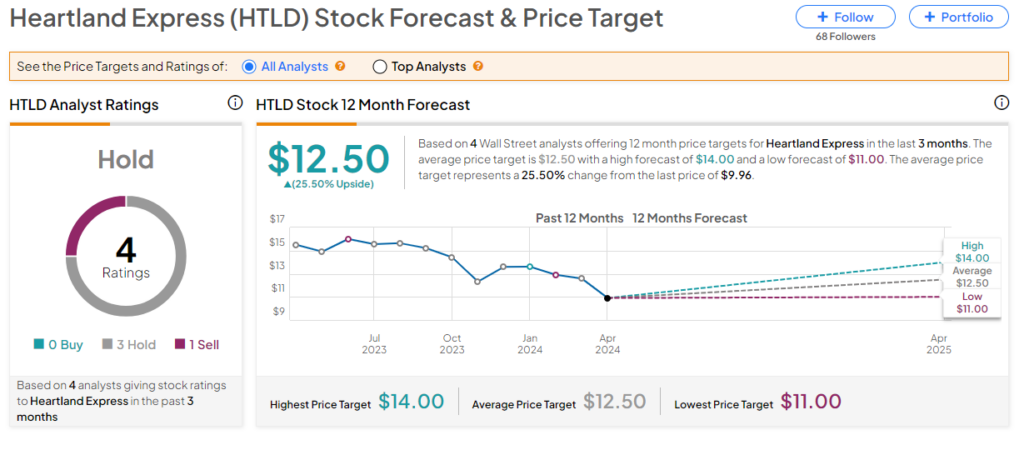

The stock has been trending down, shedding -26% YTD, and currently sits close to the bottom of its 52-week price range of $9.84-$17.08. It demonstrates negative price momentum, trading below the 20-day ($11.17) and 50-day ($11.84) moving averages.

Analysts following the company have taken a cautious stance on the stock. For instance, JPMorgan analyst Brian Ossenbeck recently lowered the price target on the stock to $12 from $13 while maintaining a Neutral rating. He cites soft expectations based on the guidance of management.

Heartland Express is rated a Hold based on the recommendations and 12-month price targets four Wall Street analysts have issued in the past three months. The average price target for HTLD stock is $12.50, which represents a 25.50% upside from current levels.

Key Takeaways on HTLD

The challenging economic environment for truckload carriers has impacted Heartland Express. Despite posting disappointing recent earnings, the company presents potential for investors as it navigates these rough waters and seeks to participate in the early stages of a trucking industry rebound. While the stock currently demonstrates negative price momentum, an eventual turn in the industry could catalyze recovery and unlock the stock’s upside potential. Investors may want to wait and watch closely for early signs of recovery before taking a position.