Healthcare is one of the largest and fastest-growing sectors in the U.S. economy, with a $4.5 trillion market that accounts for over 17% of GDP. The pandemic’s unprecedented demands helped to break down longstanding barriers to technology innovation, while spurring the embrace of technological advancements at a rapid pace. As healthcare continues to evolve, innovative digital tools are set to revolutionize care delivery, payment processing, and health record management. HealthStream (NASDAQ:HSTM)’s strong financial results in this fast-growing sector could make this stock a compelling option.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

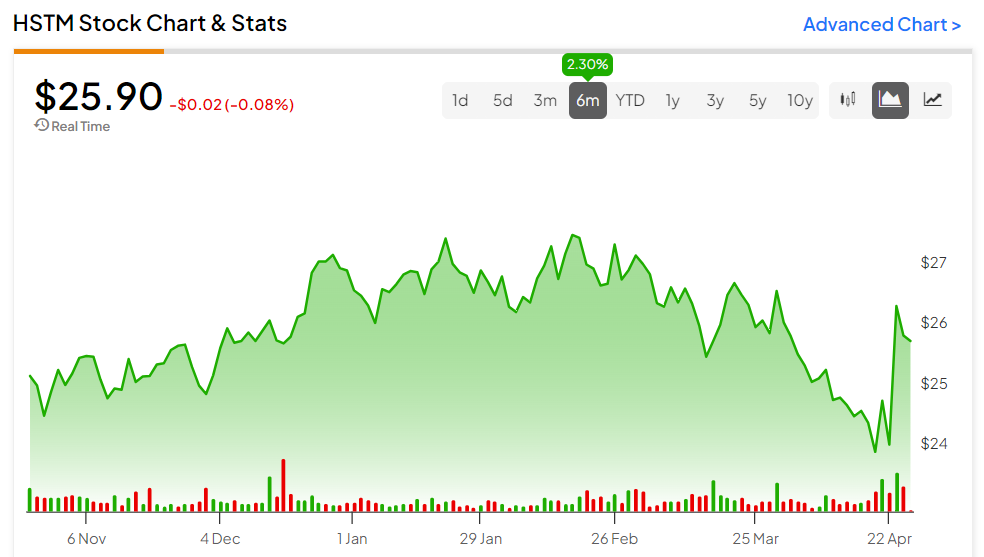

The stock jumped up after reporting its Q12024 results, and grabbing investors’ attention. The stock has attractive characteristics like strong earnings growth, high profitability, and low volatility.

HealthStream’s Market-Leading Healthcare SaaS

HealthStream is a healthcare technology firm and one of the leading network providers in the sector. The company counts over 4,000 healthcare organizations across the country as clients, including an impressive 70% of all U.S. hospitals and healthcare systems, and has over 4.5 million active subscribers on its platform.

The company’s SaaS enterprise-level, subscription-based products encompass a broad spectrum of services focused on workforce development and management in the healthcare industry. These include training and learning management, nurse and staff scheduling, clinical education, credentialing, privileging, provider enrollment, performance assessment, and managing simulation-based education programs.

HealthStream has estimated that its total addressable market is the 12.3 million individuals focused on healthcare delivery, with expectations that healthcare will remain one of the fastest-growing industries through 2031.

Analysis of HealthStream’s Recent Financial Performance

The company recently released first-quarter numbers that demonstrated solid financial results. Revenues of $72.8 million represented 6% growth from the first quarter of 2023 and beat the expected consensus of $71.88 million. Impressively, earnings per Share (EPS) beat expectations, reaching $0.17, significantly surpassed the anticipated $0.11 consensus.

As of March 31, 2024, the company boasted a robust balance sheet with cash and cash equivalents, along with marketable securities totaling $83.7 million and no outstanding debt. Furthermore, the board approved a quarterly cash dividend of $0.028 per share, payable on May 17, 2024, to shareholders of record on May 6, 2024.

Management has issued its 2024 Revenue guidance, with revenue in the range of $292 million to $296 million, with a midpoint slightly below the consensus at $293.65 million. Revenue has seen relatively consistent growth, and given that 96% of revenues are subscription-based, there is a high degree of confidence this trend will continue.

What is the Price Target for HSTM Stock?

The stock has been trending up, climbing over 2% in the past six months. It sits in the upper half of the 52-week price range of $20.47-$29.12 and continues to show positive price momentum, trading above the 20-day (25.23) and 50-day (25.77) moving averages. It appears relatively fairly valued with a P/S ratio of 2.8x, which is in line with the Health Information Services industry average of 2.7x.

Analysts following the company have been cautiously optimistic about the stock. For instance, Barrington analyst Vincent Colicchio has issued a Hold recommendation on the stock while noting the recent strength in subscription revenue growth.

HealthStream is rated a Moderate Buy based on the recommendations and 12-month price targets that five Wall Street analysts have issued over the past three months. The average price target for HSTM stock is $31.67, which represents a 22.61% upside from current levels.

HSTM Stock in Summary

The healthcare sector is innovating rapidly, and HealthStream has emerged as a market leader in the healthcare technology ecosystem. For investors interested in stocks with robust performance in a dynamic market, HealthStream could tick the box. The company’s upward trajectory, bolstered by its strong Q1 financial performance, could make it an attractive option for those looking to invest in the burgeoning healthcare technology sector.