Amid the rising popularity of wireless internet services on airplanes, Hawaiian Airlines, Inc., a subsidiary of Hawaiian Holdings, Inc. (NASDAQ: HA) has clinched a deal with Starlink. The financial details were kept under wraps.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Starlink is Tesla (TSLA) CEO Elon Musk’s satellite-internet business SpaceX’s broadband unit.

Benefits of the Agreement

Through the deal, Hawaiian will become the first major airline to equip passengers with internet on flights between the islands and the continental U.S., Asia, and Oceania. In a press release, the company noted it will provide “complimentary high-speed, low-latency broadband internet access” through Starlink satellite internet connectivity service on its Airbus A330 and A321neo aircraft, along with Boeing 787-9s, to be initiated soon.

However, Hawaiian will not provide these internet services on its short flights between the Hawaiian Islands on Boeing 717 aircraft.

Hawaiian and Starlink are likely to start the installation of services next year.

Background

For years, SpaceX, a manufacturer of the world’s most advanced rockets and spacecraft, was working on Starlink. It had sent internet satellites into the lower orbit and sold broadband services to both enterprises and individuals.

SpaceX and Starlink expect 40 million subscribers by 2025.

Official Comments

In their release, Hawaiian Airlines President and CEO Peter Ingram said, “When we launch with Starlink we will have the best connectivity experience available in the air…Our guests can look forward to fast, seamless and free Wi-Fi to complement our award-winning onboard Hawaiian hospitality.”

Wall Street’s Take

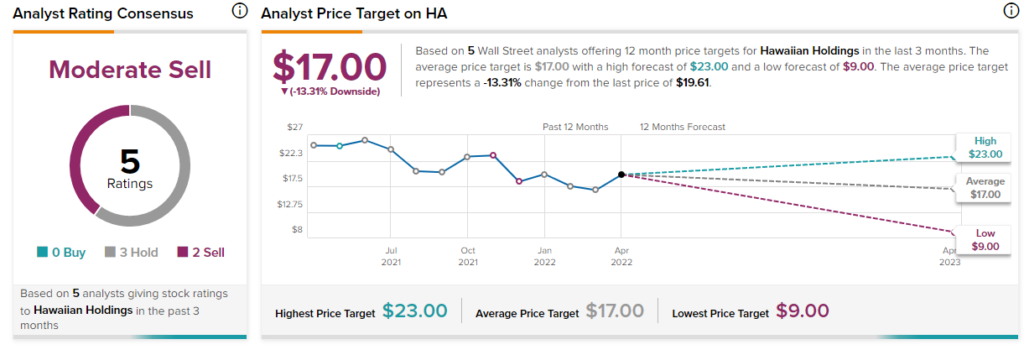

Recently, Deutsche Bank analyst Michael Linenberg downgraded Hawaiian Holdings to a Hold from a Buy and lowered the price target to $23 (17.29% upside potential) from $25.

According to Linenberg, despite the revival in the travel industry, Hawaiian’s international business depends on the Asia-Pacific market, which is still bearing the brunt of COVID-19 restrictions and foreign exchange headwinds.

The rest of the Street is bearish on the stock with a Moderate Sell consensus rating. That’s based on three Holds and two Sells. The average Hawaiian price target of $17 implies 13.31% downside potential to current levels. Shares have lost 22.67% over the past year.

Investor Wisdom

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on Hawaiian Holdings, with 5.4% of investors maintaining portfolios on TipRanks decreasing their exposure to HA stock over the past seven days.

Bottom-Line

Despite such a positive move in the airline industry with Starlink, Hawaiian Holdings might find investors skeptical about investing in the stock, given the company’s expected first-quarter loss, low analyst ratings, existing headwinds despite a revival in the sector, recent price movements, and competitive pressure.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

NextEra Energy: Mixed Quarterly Results, Price & Supply Issues Continue

Intuitive Surgical Posts Quarterly Beat; Shares Drop

Twitter Faces Jack Dorsey’s Criticism