Property and casualty (P&C) insurer Hartford Financial Services Group announced that it has received an unsolicited and non-binding takeover offer from Chubb Limited.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Hartford (HIG) said that its board is assessing the proposal and has employed financial and legal advisors for assistance on the deal.

Chubb (CB) said that it has agreed to pay $65 for each Hartford share, which reflects a “premium of 26% based on its unaffected 20-day volume-weighted average share price of $51.70 as of March 10, 2021.” Chubb added that the offer represents a “mix of stock with the majority in cash.”

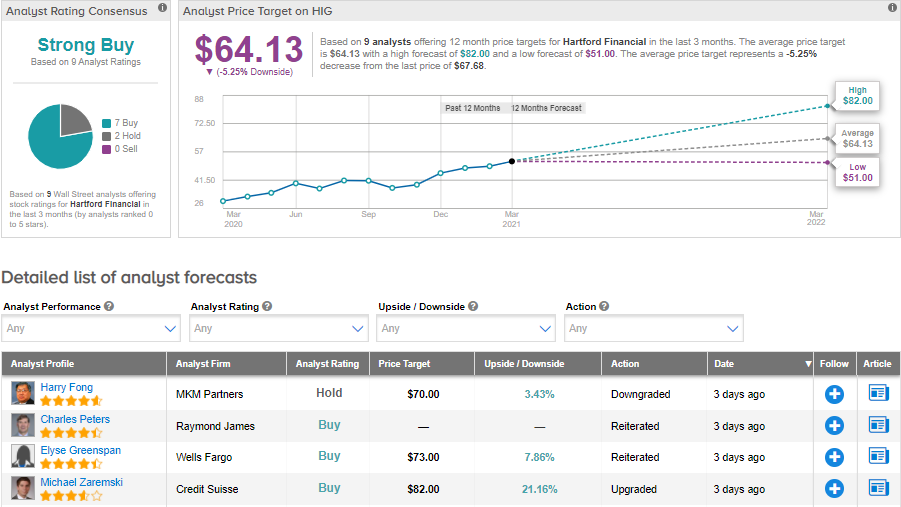

On March 19, MKM Partners analyst Harry Fong downgraded Hartford to Hold from Buy but raised the stock’s price target to $70 (3.4% upside potential) from $65. In a note to investors, Fong stated that a deal valuing the company at 1.5 times book value looks feasible, which values its stock at $70.70 per share.

Last month, the company delivered stronger-than-expected bottom-line results with adjusted EPS of $1.76 beating Wall Street estimates of $1.32 a share. (See Hartford stock analysis on TipRanks)

Overall, the Street has a Strong Buy consensus rating on the stock based on 7 Buys and 2 Holds. The average analyst price target of $64.13 implies a downside potential of about 5.3% to current levels. Shares gained about 166% in one year.

Related News:

Blackstone Bids To Snap Up Australian Casino Operator Crown Resorts

Enova Snaps Up Pangea Universal Holdings

Roku Acquires “This Old House”; Street Sees 38% Upside