Guidewire Software, Inc. (GWRE) swung to a loss in the fiscal third quarter but reported better-than-expected revenue driven by solid growth in subscriptions.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Guidewire provides a technology platform comprised of software, services, and a partner ecosystem, for the global Property and Casualty insurance industry.

The company reported a loss of $0.16 per share in Q3, better than the Street’s estimated loss of $0.24 per share. In the same quarter last year, the company reported earnings of $0.09 per share.

Revenue came in at $164 million, down 2% from the prior-year quarter but outpaced the Street’s estimates of $157.74 million.

Compared to the year-ago period, subscription and support revenue grew 28% to $64.8 million, while license revenue declined 19% to $50.9 million. Additionally, services revenue fell 11% to $48.2 million. Annual recurring revenue (ARR) stood at $538 million. (See Guidewire stock analysis on TipRanks)

Mike Rosenbaum, the company’s CEO stated, “I am particularly excited about our momentum on the Guidewire Cloud Platform with the recent Cortina release, which further empowers our cloud customers to engage, innovate, and grow efficiently.”

For the fiscal fourth quarter, the company forecasts revenue to be in the range of $218 million to $224 million, while the consensus is pegged at $222.7 million. The company also forecasts ARR revenue between $562 million and $569 million.

For the Fiscal Year 2021, revenue is projected to fall in the range of $732-$738 million compared to the Street’s estimates of $730.4 million.

Following the results, Needham analyst Mayank Tandon maintained a Buy rating on the stock and said “While the ongoing model transition away from license sales towards cloud-based subscription deals is expected to continue into FY22, we remain constructive on the shares given the impressive subscription revenue growth and improving ARR trends. While we expect there to still be some ‘lumpy’ quarters during the model transition, we believe that GWRE is well-positioned to capitalize on the strengthening P&C insurance carrier demand for cloud-based software.”

Tandon lowered the price target on the stock to $120 from $125, which implies 18.4% upside potential to current levels.

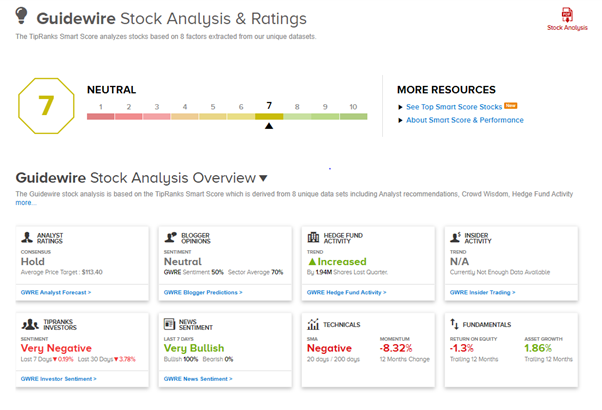

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 3 Buys, 3 Holds, and 1 Sell. The average analyst price target of $116.17 implies 14.7% upside potential to current levels. Shares have lost 11.2% over the past year.

According to TipRanks’ Smart Score system, Guidewire gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

Zoom Q1 Earnings & Revenue Outperform; Raises FY22 Guidance

Iteris Reports Q4 Loss, Beats Revenue Expectations

Old National and First Midwest Ink All-Stock Merger Deal