In the wake of uncertain U.S. consumer spending and mixed performance within the retail sector, Guess? (NYSE: GES), an out-of-favor and highly shorted apparel stock presents a unique contrarian value play investment proposition. The company beat top-and-bottom-line expectations last quarter, and a repeat performance on the next earnings report could catalyze shares higher and potentially trigger a ”short squeeze” rally for the stock. This event causes a sudden rise in the price of an asset and forces traders who previously ‘shorted’ the shares to end their position.

Furthermore, strategic moves like the recent acquisition of retailer Rag & Bone may position the company to address longer-term growth opportunities. The stocks are currently trading at a significant discount to industry peers and look to be a potential value play for investors looking for an opportunity in the retail market.

Expansion of GES Portfolio

Guess? is a prominent player in global apparel retail, operating in over 100 countries and generating an annual revenue exceeding $2.5 billion. GES has undergone a significant transformation in recent years, successfully embracing the affordable luxury market and improving its profitability margins as a result.

Recently, the company expanded its portfolio by acquiring New York-based fashion brand Rag & Bone for the definitive sum of $56.5 million. The transaction, still waiting on regulatory approvals, completed with global brand management firm WHP Global, entails that Guess? has assumed full ownership of all Rag & Bone operating assets while entering a joint venture with WHP Global to secure Rag & Bone’s intellectual property rights.

Recent Financial Results & Outlook of GES

In the first quarter of 2025, Guess? reported stronger results than analysts had predicted. Revenue for the quarter was $591.94 million, a year-over-year 4% increase that surpassed the expected revenue of $574.64. The company’s earnings per share (EPS) were -$0.27, exceeding the analysts’ estimate of -$0.40.

The Board of Directors approved a quarterly cash dividend of $0.30 per share, equating to a dividend yield of 5.16%, payable to shareholders on June 28, 2024.

Management has issued future guidance, with estimates for a 10.7% to 12.7% boost in revenue for the full fiscal year 2025. GAAP and Adjusted Operating Margins are anticipated to be between 7.3% and 8.1% and 7.7% and 8.5%, respectively, along with GAAP EPS between $2.59 and $2.89 and Adjusted EPS between $2.62 and $3.00.

What Is the Price Target for GES Stock?

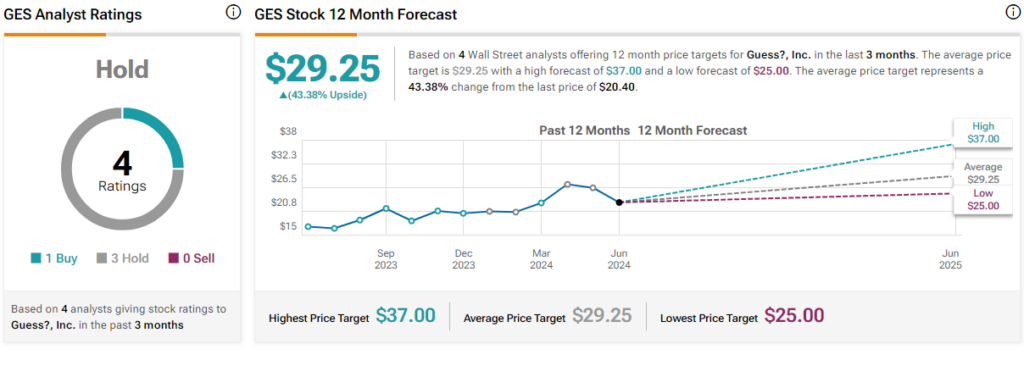

Analysts following the company have taken a cautious stance on the stock. For example, Jefferies analyst Corey Tarlowe, a five-star analyst according to Tipranks ratings, recently lowered the price target on the shares from $29 to $25 while maintaining a Hold rating. He noted that the Q1 top-and-bottom-line results beat expectations but expects the company to continue to face softer consumer trends.

Guess? is rated a Hold based on the aggregate recommendations and price targets recently issued by four analysts. The average price target for GES stock is $29.25, representing a potential upside of 43.38% from current levels.

The stock has been on a downward trend since early Spring, shedding over 31% in the past three months. It trades at the low end of its 52-week price range of $15.64 – $30.00 and continues to show negative price momentum, trading below its 20-day ( 21.64) and 50-day (23.05) moving averages. It looks to be oversold, with an RSI of 26.78, including a healthy percent of shares outstanding (17.5%) held in short interest. Yet, with a P/E ratio of 6.04x compared to the Apparel Retail industry average of 25.09x, it looks to be trading at a deep relative value.

Bottom Line on GES

Guess? presents a compelling investment opportunity in a volatile retail industry. It has surpassed financial expectations in the past quarter, and repeated success in forthcoming reports could stimulate share price growth. The company’s forecasts continue to show promising growth and profitability. Finally, the stock trades at a steep discount, which makes it an attractive proposition for contrarian value investors.