Shares of GSX Techedu closed 8% lower on Friday after the China-based technology-driven education company reported a wider-than-expected loss for 3Q. The company reported a loss per American Depository Share (ADS) of $0.57 for 3Q, which was wider than analysts’ expectations of a loss of $0.31 per ADS.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

GSX Techedu’s (GSX) bottom-line took a hit from increased operating expenses which more than offset the benefit of higher revenues. The company’s operating expenses rose six-fold to RMB2.45 billion from RMB411.1 million in the year-ago quarter, reflecting increased compensation to staffs along with higher marketing and research & development expenses.

Meanwhile, GSX Techedu’s revenues skyrocketed 252.9% to RMB1.97 billion. The company noted, “The increase was mainly driven by the growth in paid course enrollments for K-12 courses. The number of online K-12 paid course enrollments increased 140.5% year-over-year to 1,147 thousand, which was contributed by both first-time paid course enrollments and retention of existing students.”

In US dollar terms, the company’s total revenues amounted to $289.5 million, which topped the Street’s estimates of $288.5 million. (See GSX stock analysis on TipRanks)

For 4Q, GSX Techedu expects revenues between RMB2,076 million and RMB2,116 million, reflecting year-over-year growth of 122%-126.3%.

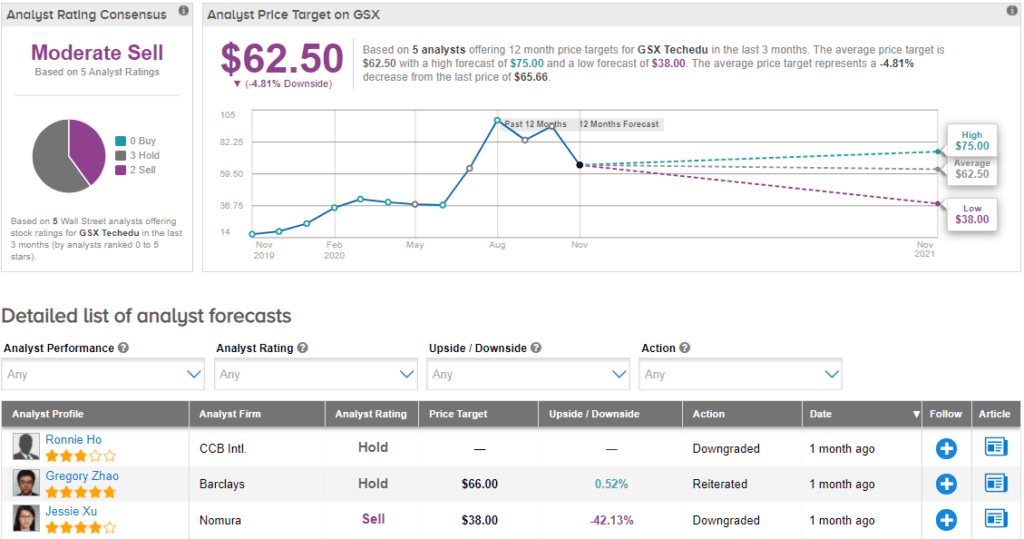

On Oct. 26, Barclays analyst Gregory Zhao trimmed the stock’s price target to $66 (0.5% upside potential) from $77 and reiterated a Hold rating. Zhao forecasts that GSX might see “substantial pressure” on its sales and margins over the next couple of quarters given the intensifying competition in the online tutorial market across China.

Currently, the Street has a cautiously pessimistic outlook on the stock. The Moderate Sell analyst consensus is based on 2 Sells and 3 Holds. The average price target stands at $62.50 and implies downside potential of about 4.8% to current levels. Shares have skyrocketed over 200% year-to-date.

Related News:

Williams-Sonoma Pops 7% On Blowout 3Q Earnings; Analyst Raises PT

Western Union Buys 15% Stake In Saudi Telecom’s Payments Unit For $200M

Verizon Sells HuffPost To BuzzFeed In Online Media Deal