Shares of Groupon soared nearly 28% in the pre-market session on Friday after the online coupon company surpassed Street estimates by a wide margin. Though its sales and earnings declined year-over-year, cost-savings measures boosted its bottom line.

Groupon (GRPN) reported a loss of $0.93 per share, narrower than the analysts’ expectations of a loss of $2.75 per share. Lower gross profit and a decline in adjusted EBITDA weighed on the company’s 2Q profits. The company reported earnings of $0.20 in the year-ago quarter. Revenues of $395.6 million also exceeded the Street estimates of $183.3 million, but were way behind the year-ago revenues of $532.6 million, due to lower units sold due to COVID-19-related pressures.

Groupon interim CEO Aaron Cooper stated, “In the past four months, we have created significant operating leverage by taking substantial costs out of our business, leaned into categories to drive sales and free cash flow, and steadied the company during the pandemic.” The company is also planning to start the second round of layoffs in August to reduce its expenses. In April, Groupon said it was planning to furlough about 44% of its total workforce by July 2021.

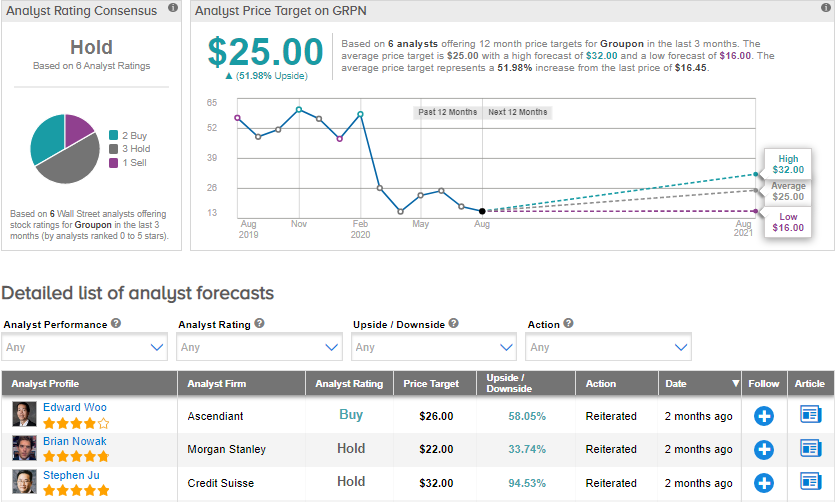

Earlier on June 18, Wedbush analyst Ygal Arounian lowered the his price target on Groupon to $22 (33.7% upside potential) from $35, with a Hold rating. Arounian had expected that Groupon would continue to “face a challenging operational environment, with significant demand headwinds likely to weigh through the end of Q2 and possibly 2020.”

Currently, the Street has a cautious outlook on the stock. The Hold analyst consensus is based on 3 Holds, 2 Buys and 1 Sell. The average price target of $25 implies an upside potential of about 52%. (See GRPN stock analysis on TipRanks).

Related News:

Cloudflare Beats 2Q Estimates On Strong Customer Growth

Fortinet Slips 7% After-Hours As 2Q Billings Missed Estimates

Yelp Up 5% On Q2 Beat; RBC Says Stock ‘Needs A Vaccine Too’