Each quarterly report is like a snapshot of a company’s financial health. A recent snapshot of GoPro (NASDAQ:GPRO) indicates that the company is struggling in certain respects. Still, I’m neutral on GPRO stock overall, as it looks oversold after today’s plunge.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

GoPro makes small, portable cameras that you can easily strap to your body and take just about anywhere. These “action cameras” are ideal for first-person video streaming. As we’ll discuss in a moment, GoPro doesn’t seem to have a problem selling its products, but turning those products into profits is a different story entirely.

GoPro Sells Cameras and Gains Subscribers but Disappoints Investors

I’ll start with the good news. In 2023, sold three million cameras, up 6% year-over-year, and grew its subscriber count by 12% to 2.5 million. So, why did GPRO stock fall by 11% today?

The problem, evidently, is that GoPro hasn’t succeeded in converting its camera sales and subscriptions into strong revenue and profits. In the fourth quarter of 2023, GoPro’s revenue declined by 8% year-over-year to $295 million, while Wall Street had called for revenue of $326.13 million.

Furthermore, GoPro reported Q4-2023 earnings of $0.02 per share. That’s basically in line with Wall Street’s expectations but is much lower than the year-earlier quarter’s result of $0.12 per share.

GoPro’s management could come up with an action plan to reduce the company’s expenditures while keeping its product sales strong. This, I believe, would go a long way toward restoring the confidence of the investing community.

Is GPRO Stock a Buy, According to Analysts?

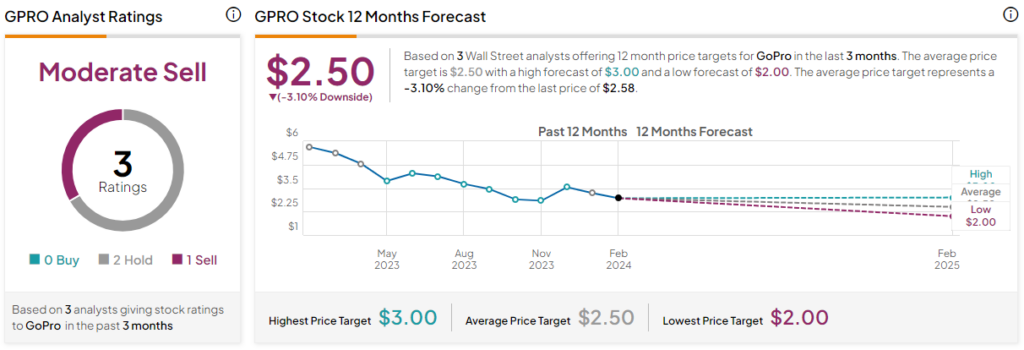

On TipRanks, GPRO comes in as a Moderate Sell based on two Holds and one Sell rating assigned by analysts in the past three months. The average GoPro stock price target is $2.50, implying 3.1% downside potential.

The Takeaway: Should You Consider GPRO Stock?

GoPro shares look pretty cheap after today’s sell-off, and the company seems capable of selling lots of little cameras. A turnaround may be possible if GoPro rolls out a major action plan that includes cost-cutting measures in order to boost profits. When all is said and done, I’m neutral on GPRO stock and am not considering a share position, though some people might choose to buy a few shares just for a fun, speculative bet.