As key Google (GOOGL) executives begin to testify as part of the U.S. Justice Department’s antitrust trial against the tech giant, some crucial information is emerging from the proceedings. Notably, it has come to light that Google considered lowering its advertising exchange fees eight years ago when websites discovered a way to boost ad revenue without relying on Google’s tools.

According to the testimony by Google executives cited by a Bloomberg report, websites selling display ads had introduced a technology called header bidding, which bypassed Google’s fees for its ad exchange (AdX) and significantly increased their revenue. However, rather than slashing its 20% fee for its ad exchange, Google opted to create a modified version of the technology in 2019. This decision reflects the company’s approach to maintaining control over its advertising ecosystem.

Google Monopolized the Ad Exchange Business

Further details emerged from the testimony of former Google executive Eisar Lipkovitz, who oversaw display and video ads from 2014 to 2019. Lipkovitz revealed that internal discussions had suggested reducing the AdX fee to a range of 10% to 15%. Despite this recommendation, Google chose to continue charging the 20% fee. DOJ lawyers argue that this decision indicates Google’s power to maintain high prices without facing significant business repercussions.

Moreover, Lipkovitz acknowledged that the high AdX fees pushed websites to adopt header bidding. This process allowed publishers to run ad auctions within the browser, significantly increasing their revenue. In fact, former News Corp. (NWSA) executive Stephanie Layser testified during the trial that header bidding helped publishers like News Corp. increase their earnings by up to 50%.

What Is the U.S.’s Antitrust Trial All About?

This brings us to the broader context of the trial. The U.S. Justice Department’s trial against Google kicked off this week amid claims that the company is monopolizing the ad tech market by controlling both customers and competitors. Notably, this is the second significant antitrust trial for Google in over a month, following its loss to the DOJ over its search dominance.

The crux of the case is that Google is accused of monopolizing the technology for buying and selling online display ads. The company allegedly controls a vast pipeline of products used by websites and advertisers, along with an exchange that connects ad buyers and sellers. This level of control raises concerns about competitive fairness and market dominance.

Adding to Google’s woes, the company was also recently under scrutiny in Europe. Earlier this week, Europe’s highest court, the European Court of Justice (ECJ), upheld a €2.4 billion ($2.65 billion) fine against the tech giant. This ruling confirmed Google’s violation of antitrust laws by prioritizing its own shopping comparison service over competitors. It was another big blow for the company, showing the global regulatory hurdles Google is up against.

What Is the Future Price of GOOGL stock?

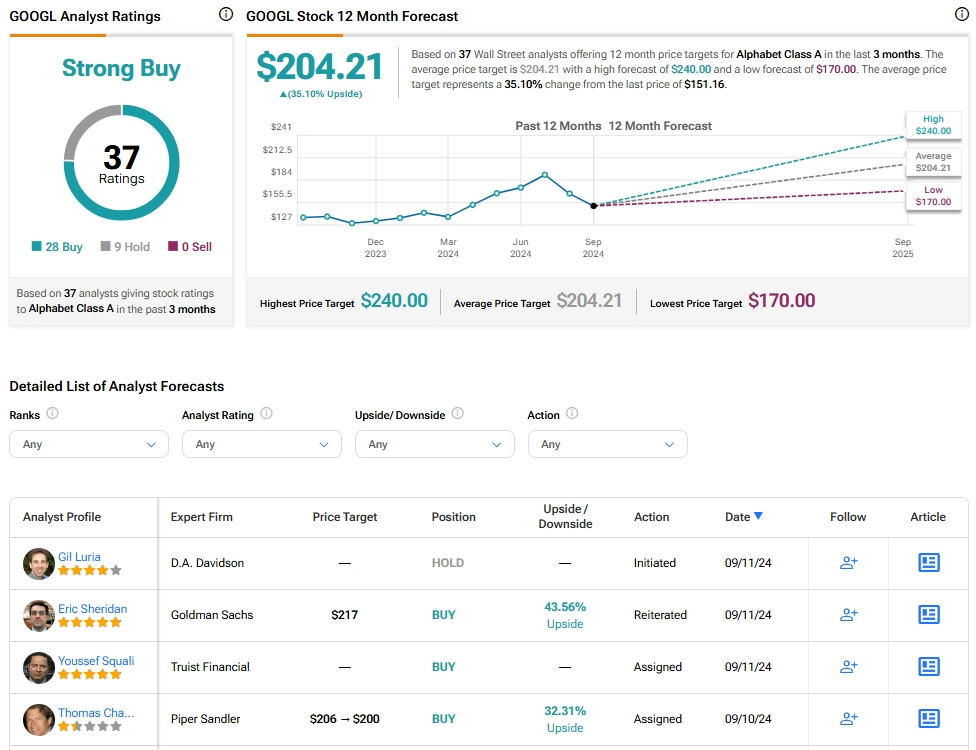

Analysts remain bullish about GOOGL stock, with a Strong Buy consensus rating based on 28 Buys and nine Holds. Over the past year, GOOGL has increased by more than 10%, and the average GOOGL price target of $204.21 implies an upside potential of 35.1% from current levels.

See more GOOGL analyst ratings

Questions or Comments about the article? Write to editor@tipranks.com