Australia’s antitrust authority is raising competition concerns about Google’s (GOOGL) planned $2.1 billion acquisition of fitness hardware-maker Fitbit (FIT).

The Australian Competition and Consumer Commission (ACCC) is concerned that a deal could potentially impede on competition in health and online advertising markets.

Back in November Google announced that it had entered into an agreement to buy Fitbit, which develops wrist-worn wearable devices such as fitness trackers. The acquisition is part of the search engine giant’s strategy to introduce Made by Google wearable devices into the market.

“Our concerns are that Google buying Fitbit will allow Google to build an even more comprehensive set of user data, further cementing its position and raising barriers to entry to potential rivals,” ACCC Chair Rod Sims said. “The access to user data available to Google has made it so valuable to advertisers that it faces only limited competition.”

The ACCC added that its inquiry found that Google’s market power is built on its concentration of search and location data, and data collected via third-party websites and apps.

“Past acquisitions by Google, of both start-ups and mature companies like Fitbit, have further entrenched Google’s position,” Sims said.

The regulator’s investigation will also focus on whether Google is likely to favour its own wearables devices over competitors’ when supplying important related services such as WearOS, Google Maps, Google Play Store or Android smartphone interoperability.

“We will work very closely with other competition authorities in other jurisdictions that are also reviewing this transaction,” Sims said.

The ACCC, which is expected to publish the outcome of its concerns on Aug. 13, is the first regulator to raise concerns about the deal. Meanwhile the European Commission is scheduled to release its call on the deal in July.

Shares in Google have surged 37% since dropping to a low in March and have now erased all of their losses suffered earlier this year. The stock was up less than 1% at $1,451.12 at the close on Wednesday.

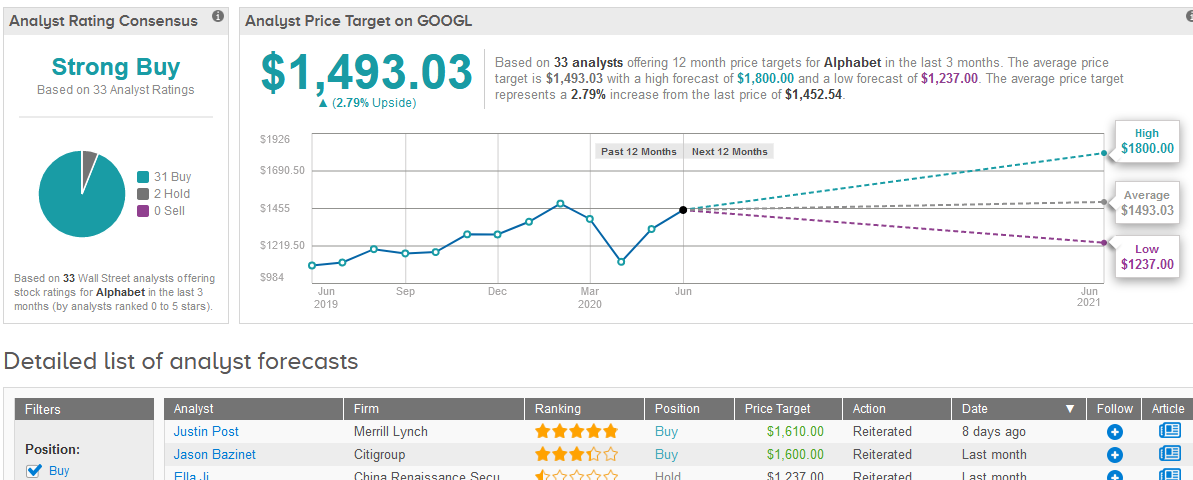

In view of the recent rally, the stock looks like almost fully priced. Indeed, the average analyst price target of $1,493.03 indicates shares have room to advance a mere 2.8% in the coming 12 months. (See Alphabet’s stock analysis on TipRanks)

Overall, the Wall Street rating outlook for Google remains bullish. The Strong Buy analyst consensus boasts 31 Buys versus 2 Holds.

Related News:

Google Mulling Purchase of Stake in Indian Vodafone Idea

Google and Carrefour Roll Out Voice-Based Shopping Service In France

Facebook’s WhatsApp Rolls Out Digital Payment Service In Brazil