Alphabet Inc’s Google (GOOGL) has announced a licensing program to pay publishers in Germany, Australia and Brazil for high-quality content.

The search engine giant has signed partnerships with local and national publications in Germany, Australia and Brazil and expects more media outlets in other countries to join the program in coming months. The new product will initially be available on Google News and Discover.

“In the last few months, COVID-19 has created new and unimagined pressures on the news industry, affecting everything from the creation of quality journalism to the continuation of traditional business models,” Brad Bender, Google’s vice-president for news, said in a blogpost. “This program will help participating publishers monetize their content through an enhanced storytelling experience that lets people go deeper into more complex stories, stay informed and be exposed to a world of different issues and interests.”

Google will also offer to pay for free access for users to read paywalled articles on a publisher’s site, where available. This will let paywalled publishers grow their audiences and open an opportunity for people to read content they might not ordinarily see, Bender added.

The move comes after Australia’s government announced in April that it seeks to force Google and Facebook Inc. (FB) to pay media outlets for news content. Australia’s competition watchdog is preparing a draft for a mandatory code of conduct between media outlets and digital platforms to be submitted by July, and legislated shortly after. The mandatory code would include revenue sharing, user data access, news content presentation, and the penalties and sanctions for non-compliance.

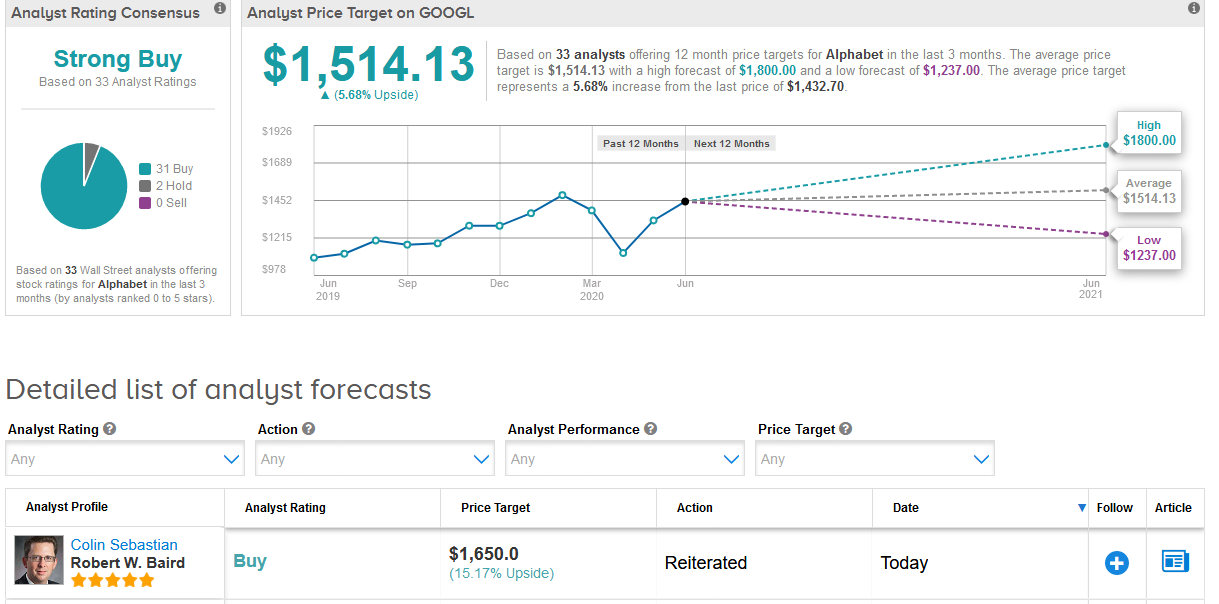

Shares in Google have surged 36% since dropping to a low in March and are now trading higher than at the start of the year. The stock declined 2.1% to $1,432.70 as of the close on Wednesday.

In view of the recent rally the stock’s upside potential looks limited. Indeed, the average analyst price target of $1,514.13 indicates shares have room to advance a modest 5.7% in the coming 12 months. (See Alphabet’s stock analysis on TipRanks)

Overall, the Wall Street rating outlook for Google remains bullish. The Strong Buy analyst consensus boasts 31 Buys versus 2 Holds.

Merrill Lynch analyst Justin Post reiterated a Buy rating on the stock with a $1,610 price target, citing a new ad program YouTube has put into place, which should improve user monetization and drive more revenue.

“YouTube launched new direct response tools that will make videos more shoppable by adding browsable product images underneath the ad to drive traffic directly to brands’ product pages,” Post wrote in a note to investors. “We see YouTube as under-earning its potential (we estimate around $8 in revenue annually, or $0.67 monthly, per monthly user in 2019), which makes new advertising initiatives important for the platform.”

Related News:

Slack Seeks To Replace E-mail With Launch Of Virtual Business Platform

Apple Reveals Custom-Made Chips, Ending Intel Relationship

Microsoft’s Xbox Closes Mixer Live Streaming, Partners With Facebook Gaming