Alphabet Inc’s Google (GOOGL) announced on Monday that it will invest about $10 billion into India over the next 5-7 years through a mix of equity investments, partnerships, and operational, infrastructure investments.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

The investment will be made through its so-called India digitalization fund as the search giant seeks to tap the country’s fast-growing and unsaturated digital market.

“This is a reflection of our confidence in the future of India and its digital economy,” said Google CEO Sundar Pichai. “Our goal is to ensure India not only benefits from the next wave of innovation, but leads it.”

Pichai added that “low-cost smartphones combined with affordable data, and a world-class telecom infrastructure, have paved the way for new opportunities”. In 2004, Google opened its first offices in India in Hyderabad and Bangalore.

Investments will focus on four areas important to India’s digitization, including affordable access and information for every Indian in their own language, whether it’s Hindi, Tamil, or Punjabi; empowering businesses as they embark on their digital transformation; and leveraging technology and AI in areas like health, education, and agriculture.

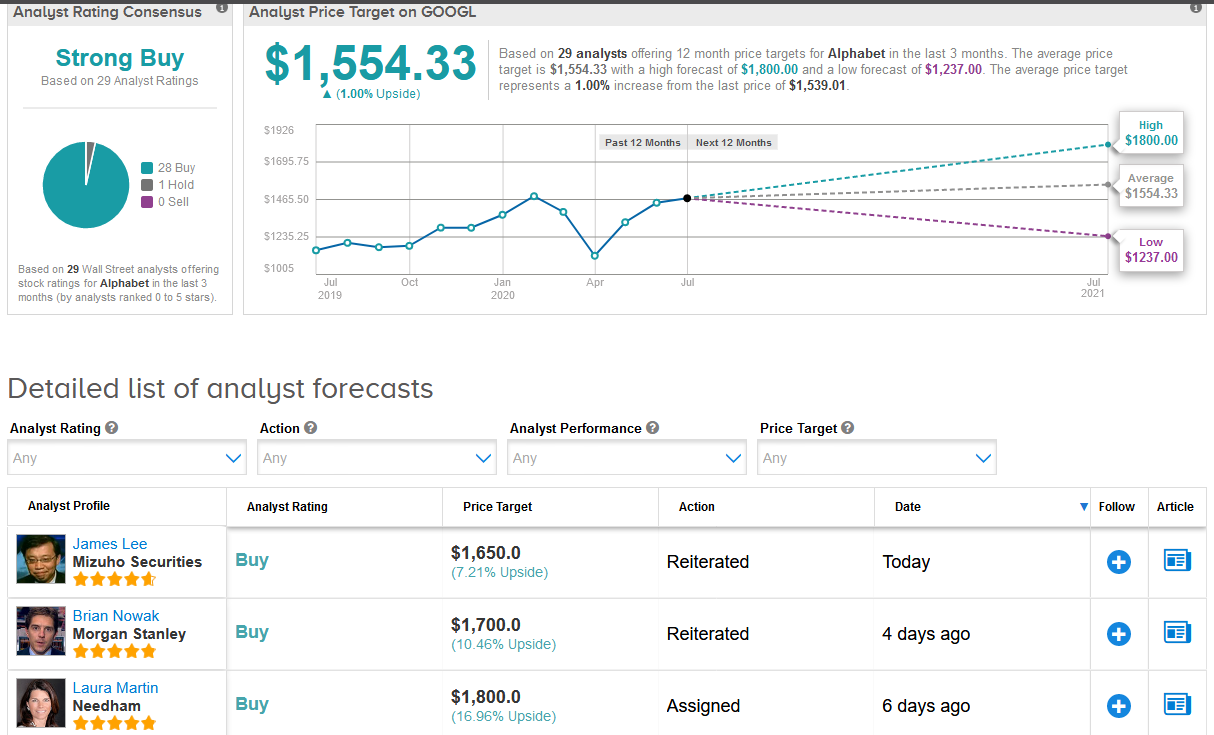

Shares in Google have fully recovered since dropping to a low in March and are now trading 15% higher than at the start of the year. The stock advanced about 1% to $1,552 in Monday’s pre-market trading.

Indeed following the rally, the stock’s upside potential now looks more limited. The average analyst price target of $1,554.33 indicates shares are almost fully priced and have a mere 1% to advance over the coming year. (See Alphabet’s stock analysis on TipRanks)

Meanwhile, five-star analyst Brian White at Monness projects some downside potential in the shares amid expectations that Alphabet’s earnings will be depressed in the coming quarters and revenue growth will be well below historical trends due to the impact of the coronavirus pandemic.

“For the foreseeable future, we anticipate Alphabet will struggle with weak digital ad spending trends and other headwinds…including uncertainty over the impact of recent ad boycotts and anti-trust investigations,” White wrote in a note to investors. “However, we believe the stock remains inexpensive and represents a core holding as this crisis accelerates the digital transformation trend.”

White has a Buy rating on the stock with a $1,420 price target (7.7% downside potential)

Overall, the Wall Street rating outlook for Google remains bullish. The Strong Buy analyst consensus boasts 28 Buys versus 1 Hold.

Related News:

Google Cloud Forges Multi-Year Deal With Renault

Apple’s Integrated Ecosystem Takes the Cake, Says Top Analyst

Game Consoles Will Provide Additional Boost to AMD, Says Top Analyst