Alphabet’s (GOOGL) Google has inked a long-term multi-year agreement with Indian communication solutions provider Bharti Airtel. The two are joining forces to accelerate the growth of India’s digital ecosystem. GOOGL shares popped 3.37% to close at $2,667.02 on Friday.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Alphabet is a holding company and parent to internet giant Google. It also owns the Google Play app store and the video platform YouTube. It generates most of its revenue from advertising. Alphabet’s upcoming earnings report for Q4 2021 is scheduled for February 1.

Google-Airtel Agreement

As part of the strategic partnership, Google will invest up to $1 billion in the global communications solutions provider. The investment comprises $700 million in equity, while $300 million will go towards scaling the company’s offerings.

The strategic partnership is expected to accelerate the development of unique products to serve customers’ needs. Additionally, the focus will be on enhancing the customer experience while offering expertise to solve problems around digital inclusion. The two will develop extensive solutions that cover Android-enabled devices and focus on removing the barriers of owning a smartphone.

Google and Airtel have affirmed their commitment to enhancing the development of an open technology ecosystem that serves customers and businesses. They are also developing digital solutions that serve India’s digital requirements.

In addition, the two companies will develop specific network domain use cases for 5G and other standards. They will also focus on shaping and growing the country’s cloud ecosystem to accelerate digital transformation.

Analysts’ Take

Last week, Credit Suisse analyst Stephen Ju reiterated a Buy rating on Alphabet stock and cut the price target to $3,400 from $3,450, implying 27.48% upside potential to current levels. According to the analyst, the company is poised to deliver strong Q4 results driven by the introduction of the infinite scroll in October.

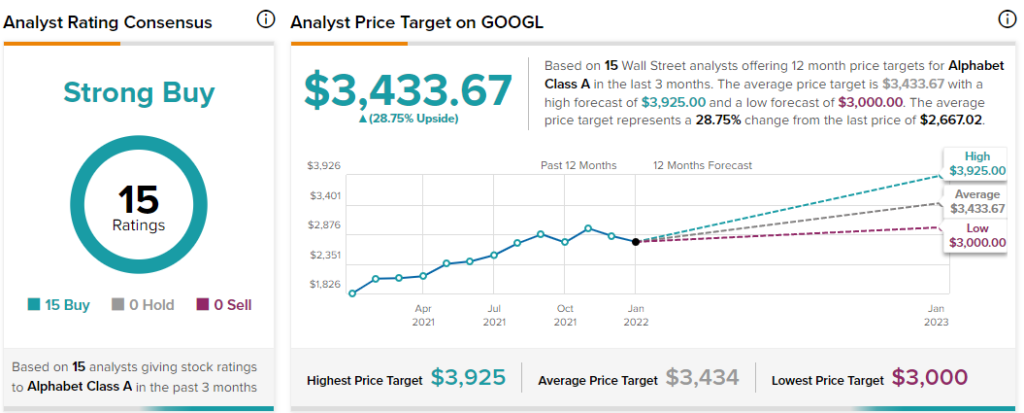

Consensus among analysts is a Strong Buy based on 15 Buys. The average Alphabet stock price target of $3,433.67 implies 28.75% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

Congressman Committed to Commercial Cannabis Banking Reform

What to Expect from JPMorgan’s Viva Wallet Acquisition

Aurora Cannabis: Attractive after Pullback?