The battle for AI supremacy heated up as tech giant Google (NASDAQ:GOOGL) unveiled its most advanced AI large language model (LLM), Gemini. Shares of GOOGL were trending up in trading on Thursday following the news.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The company has included the new version of Gemini in its chatbot, Bard. It also expects to launch its most advanced version early next year. The three versions of Gemini include Ultra, Pro, and Nano. The company is currently testing its Gemini Ultra model and will make it “available to select customers, developers, partners, and safety and responsibility experts for early experimentation and feedback before rolling it out to developers and enterprise customers early next year.”

Gemini Pro is currently being used in Bard for more advanced understanding and planning tasks. Google also intends to run the Gemini Nano model on its Pixel smartphones. Gemini Nano is a smaller version of the model, which can be used on smartphones and laptops.

Google and Alphabet CEO Sundar Pichai commented, “I believe the transition we are seeing right now with AI will be the most profound in our lifetimes, far bigger than the shift to mobile or to the web before it.”

Wall Street Remains Upbeat about Gemini

Following the news, top-rated JP Morgan analyst Doug Anmuth approved of the Gemini model’s different sizes. The analyst added that Gemini’s varied sizes catered to different use cases and hardware, addressing industry demand for cost-efficient models.

Anmuth pointed out that while there may be reservations about Ultra’s 2024 release and limited use cases for its Pro and Nano models, he was upbeat about Gemini Pro powering Google’s generative AI chatbot, Bard.

The analyst commented, “While it remains early, the Gemini launch represents significant innovation for Google as we enter year 2 of commercialized and widely distributed availability of Generative AI.”

Anmuth reiterated his Buy rating with a price target of $150 on the stock, implying an upside of 9.7% at current levels.

What is the Future Price of GOOGL?

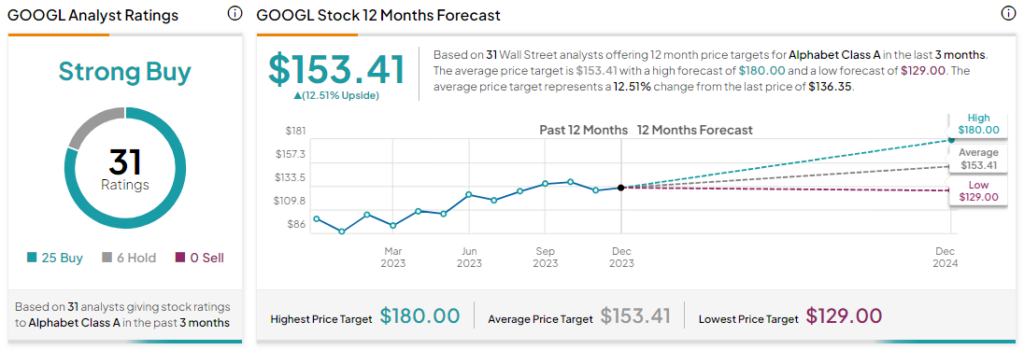

Analysts remain upbeat about GOOGL stock with a Strong Buy consensus rating based on 25 Buys and six Holds. Even as GOOGL stock has surged by more than 50% year-to-date, the average GOOGL price target of $153.41 implies an upside potential of 12.5% at current levels.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue