Google (NASDAQ:GOOGL) has finally confirmed to The Verge that certain leaked internal documents from Google pertaining to its data collection are authentic. The Verge reported earlier this week that Rand Fishkin, who has worked in Search Engine Optimization (SEO) for more than 10 years, gained access to 2,500 pages of documents from a “source.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Contents of GOOGL’s Leaked Documents

The leaked documents detail Google’s search application programming interface (API), the data it collects from webpages and searchers, and its handling of sensitive topics like elections and small websites. According to Fishkin, these documents provide indirect insights for SEO experts into Google’s priorities.

However, an analysis of these documents suggests that Google potentially collects and uses data such as clicks and Chrome user data to rank webpages, contradicting earlier claims by the company.

While these leaked documents could serve as a repository of information for Google employees, there is a possibility that this information may be outdated, used only for training purposes, or not specifically utilized for Search. Furthermore, these documents fail to clarify the weighting of different data elements in the search algorithm.

Google’s secretive search algorithm has spawned an industry of marketers who adhere to its public guidance and implement it for numerous companies. This has resulted in tactics that many believe degrade search results, inundating them with low-quality content.

GOOGL Spokesperson’s Comments

While the tech giant has admitted that the data is authentic, the company’s spokesperson also cautioned against making “inaccurate assumptions based on out-of-context, outdated, or incomplete information.” The spokesperson added that the company has shared extensive information about how its search algorithm works and what various factors its system considers to protect its results from manipulation.

Is Google Stock a Buy or Sell?

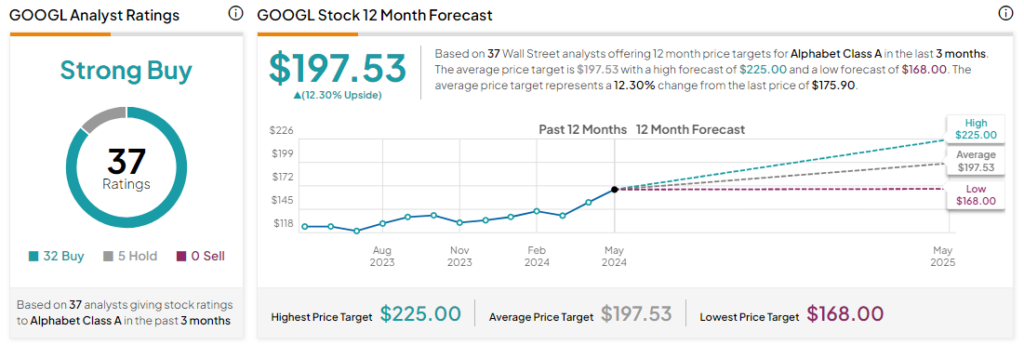

Analysts remain bullish about GOOGL stock, with a Strong Buy consensus rating based on 32 Buys and five Holds. Over the past year, GOOGL has jumped by more than 40%, and the average GOOGL price target of $197.53 implies an upside potential of 12.3% from current levels.