Google (NASDAQ:GOOGL) has filed a request in a San Francisco federal court, asking a U.S. judge to reject the broad changes proposed by Epic Games for its Play Store app in their antitrust battle. According to a Reuters report, Google’s filing argued that implementing such broad changes “would make it nearly impossible for Google to compete.”

Epic Games’ Case Against Google

Earlier this year, the gaming company urged the U.S. District Judge James Donato to compel Google to simplify the process for users to download apps from its Play Store and provide developers with greater flexibility in pricing and offering apps. Additionally, the company requested unrestricted access to its Epic Games Store on Android.

Wilson White, Google’s head of government affairs and public policy, told Reuters that Epic’s demands could jeopardize consumer privacy, security, and overall experience for both consumers and developers. Google has argued that a previous Play Store settlement with states and consumers adequately addressed Epic’s concerns regarding anticompetitive behavior.

The developer of the popular video game Fortnite, Epic Games, had previously won a case alleging that the tech giant had stifled competition by controlling app downloads on Android devices and in-app payments.

AAPL and Epic Games Tussle

Epic Games has also engaged in a legal tussle with Apple (NASDAQ:AAPL). The gaming company has petitioned a federal judge to hold Apple in contempt of court for allegedly failing to open its App Store to third-party payment options as mandated.

The legal battle between Apple and Epic Games has been going on since 2020 when the gaming company alleged that Apple violated antitrust laws by making users download apps exclusively through its App Store. Moreover, the iPhone maker has also been accused of stifling competition.

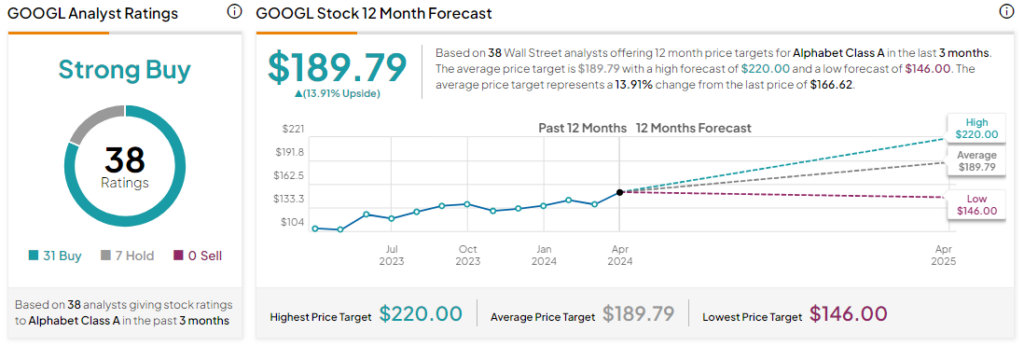

Is Google a Strong Buy Right Now?

Analysts remain bullish about GOOGL stock, with a Strong Buy consensus rating based on 31 Buys and seven Holds. Over the past year, GOOGL has increased by more than 50%, and the average GOOGL price target of $189.79 implies an upside potential of 13.9% from current levels.