The state of Arizona has filed a consumer fraud lawsuit against Alphabet Inc’s Google (GOOGL) over its location data practices. “Though Google claims to have obtained consent to collect and store its users’ data, that consent is based on a misleading user interface, as well as other unfair and deceptive acts and practices,” the lawsuit claims.

Attorney General Mark Brnovich tweeted that the state brought forward this action, which seeks unspecified damages, to “put a stop to Google’s deceptive collection of user data, obtain monetary relief, and require Google to disgorge gross receipts arising from its Arizona activities.”

Arizona’s investigation of Google began following a 2018 Associated Press article alleging that many Google services on Android devices and iPhones store your location data even if you have used a privacy setting that says it will prevent Google from doing so. “Computer-science researchers at Princeton confirmed these findings at the AP’s request” the article stated.

AP’s investigation shows “how users are lulled into a false sense of security, believing Google provides users the ability to actually disable their Location History” the Attorney General added.

Brnovich also told the Washington Post: “When consumers try to opt out of Google’s collection of location data, the company is continuing to find misleading ways to obtain information and use it for profit.”

In response to the lawsuit, Google stated: “The Attorney General and the contingency fee lawyers filing this lawsuit appear to have mischaracterized our services. We have always built privacy features into our products and provided robust controls for location data.”

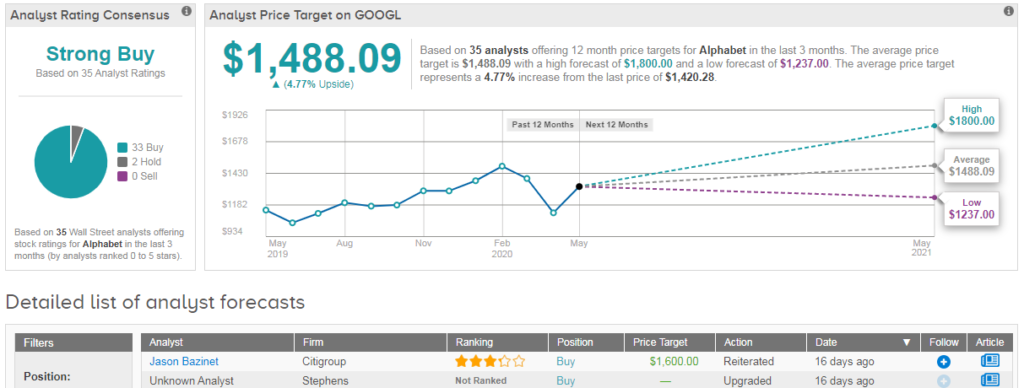

Shares in Google are up 6% on a year-to-date basis, and the Wall Street outlook for the stock remains bullish. GOOGL has a Strong Buy analyst consensus with 33 Buy ratings and 2 Hold ratings. Meanwhile the average analyst price target of $1,488.09 indicates 5% upside potential for in the coming 12 months. (See Alphabet’s stock analysis on TipRanks).

Related News:

Google Pay App May Face Anti-Trust Probe In India – Report

Facebook Canada Faces C$9 Million Fine Over ‘False’ Privacy Claims

Google, Apple Roll Out Coronavirus Contact Tracing Technology