The Goldman Sachs Group, Inc. (GS) announced that it has acquired NN Group’s asset management unit, NN Investment Partners, in a deal worth €1.7 billion. With this, the company now holds about $2.8 trillion in assets under supervision globally.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Based in New York, Goldman is a global investment banking, securities and investment management firm. Shares of the company have declined 18.2% so far this year.

As per the agreed terms, Goldman Sachs Asset Management will integrate the newly bought business along with its 900 employees. Also, it has signed a long-term strategic partnership agreement with NN Group under which Goldman is liable to manage a nearly $180 billion portfolio of assets

With this deal, Goldman will be able to build on new abilities and bolster product offerings such as European equity and investment grade credit, sustainable and impact equity, and green bonds.

The Chairman and CEO of Goldman Sachs, David Solomon, said, “This acquisition advances our commitment to put sustainability at the heart of our investment platform. It adds scale to our European client franchise and extends our leadership in insurance asset management.”

Analyst’s Take

Last week, Piper Sandler analyst Jeff Harte reiterated a Buy rating on Goldman but lowered the price target to $430 from $465. The new price target implies 33.8% upside potential from current levels.

The analyst is of the opinion that the global banks’ Q1 top line may have been impacted by capital market-related headwinds amidst heightened macro uncertainty and market volatility on account of Russia’s invasion of Ukraine.

Consensus among analysts is a Moderate Buy based on 10 Buys and five Holds. Goldman Sachs’ average price forecast stands at $434.36 and implies upside potential of 35.2% to current levels.

Website Traffic

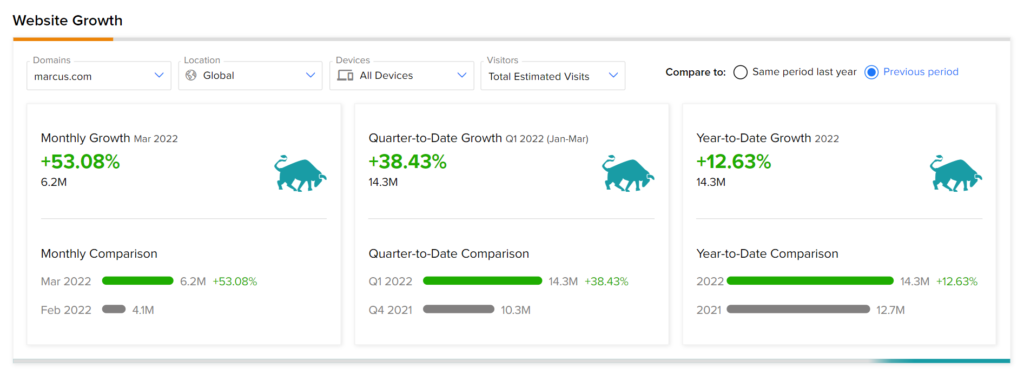

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into GS’ performance.

According to the tool, Goldman’s banking website recorded a 53.1% monthly increase in global visits in March, compared to the previous year. Likewise, the footfall on its website has grown 12.6% year-to-date against the same period last year.

Takeaway

The recent acquisition is expected to help Goldman strengthen its presence in the European market and expand its product offerings. This bodes well for the company’s performance in the upcoming quarters.

Furthermore, while uncertainties in the market may have impacted capital market revenues for Goldman, its Q1 banking revenues are likely to have witnessed an uptrend as indicated by the website traffic report.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Zynex Releases Q1 Expectations

Why Was Akebia Trading Lower in Pre-Market Session?

Novavax Receives Authorization to Inject COVID-19 Vaccine in Thailand