Shares of Goldman Sachs Group (NYSE: GS) plunged 7% to close at $354.4 on Tuesday after the investment bank reported worse-than-expected fourth-quarter results. A weak trading environment and higher compensation costs weighed down earnings.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Meanwhile, Goldman, one of the top S&P 500 companies, retained its #1 ranking in worldwide announced and completed mergers and acquisitions, global equity and equity-related offerings, common stock offerings, and initial public offerings for 2021, the bank said.

Results in Detail

Goldman reported earnings of $10.81 per share, missing the Street’s estimates of $11.76 per share by a wide margin. It reported earnings of $12.08 per share in the same quarter last year.

Goldman’s total operating expenses jumped 23% year-over-year to $7.3 billion, which reflected a 31% rise in compensation and benefits. Headcount also rose 8% year-over-year in the quarter.

Riding on credit card balances, provision for credit losses escalated to $344 million from $293 million in the same quarter last year.

On the positive side, total net revenue of $12.64 billion beat the Street estimates of $12.08 billion and grew 8% year-over-year. The rise in investment banking revenues, as well as elevated consumer & wealth management revenues, drove the surge.

Segmental Revenues

Investment Banking revenues were $3.8 billion in the quarter, up 45% year-over-year, driven by outstanding performance in the debt underwriting business and high financial advisory revenues. Notably, a rise in completed mergers and acquisitions volumes in the quarter was positive.

The Consumer and Wealth Management division recorded a 19% jump to $1.97 billion, while Asset Management revenues came in at $2.89 billion, down 10%. Also, net revenues in Global Markets decreased 7% to $4 billion on the back of weak equities business (down 11%).

Full-year 2021 Results

For 2021, the bank reported earnings of $59.45 per share, compared with $24.74 per share in the prior year. Notably, last year’s results included the impact of net provisions for litigation and regulatory proceedings of $9.51 per share. Total net revenue grew 33% year-over-year to $59.3 billion.

Analysts’ Recommendations

Following the recent Goldman earnings report, J.P. Morgan analyst Kian Abouhossein maintained a Buy rating and a price target of $465 (31.21% upside potential) on the stock.

Abouhossein remains positive on Goldman, with the belief that the bank’s market share will continue to rise, along with increasing Book Value Per Share growth.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 6 Buys and 4 Holds. The average Goldman price target of $474.11 implies 33.78% upside potential to current levels. Shares have increased more than 24.2% over the past year.

Risk Analysis

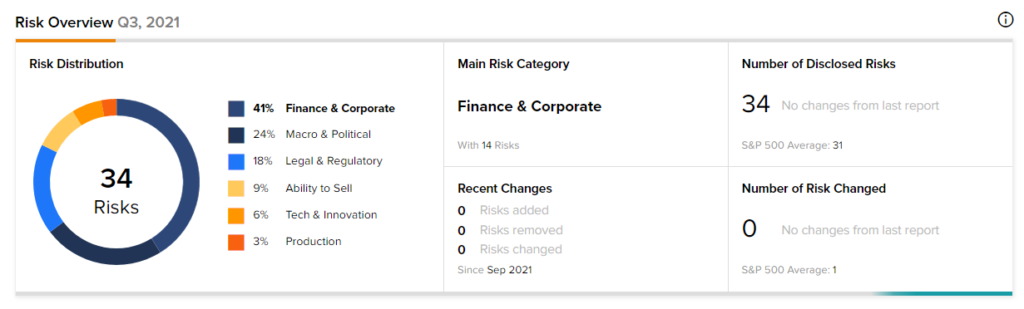

According to the new TipRanks Risk Factors tool, Goldman stock is at risk mainly from three factors: Finance and Corporate, Macro & Political, and Legal and Regulatory, which contribute 41%, 24%, and 18%, respectively, to the total 34 risks identified for the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

AstraZeneca: FDA Priority Review for Enhertu could Boost Stock

AWS & TD Synnex Collaborates to Enhance Digital Offerings

Eli Lilly Inks Collaboration Deal with Abbisko