Rivian Automotive (NASDAQ:RIVN) stock bounced 16% over the past two trading sessions, erasing almost half the losses the stock had suffered in the wake of its disastrous Q4 earnings report late. If you recall, Rivian reported a slightly less-bad-than-feared loss last month, and slightly better-than-hoped sales – but then struck a decidedly sour note when the company told investors it would hold electric vehicle production numbers steady in 2024, producing no more than the 57,000 EVs it had produced in 2023, and therefore growing its production rate not at all.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

So how did Rivian recover from last month’s fumble? By announcing not one, but two (and arguably even three) new EV models that it will be bringing to market over the next few years.

Goldman Sachs analyst Mark Delaney was present at Rivian’s launch event for the new EVs, dubbed respectively the R2 and R3 (and also the R3X). As Delaney relates, though, it’s the long-awaited R2 that investors will focus on most immediately (The R3 was kind of a surprise). So let’s focus on the R2 for now.

Rivian described how it will bring R2 to market by producing the new electric SUV at its existing factory in Normal, Illinois, instead of waiting for a new factory to be first built in Georgia for this purpose. This strategic decision has two main effects:

First, producing at a factory that has already been built will allow Rivian to begin production (and sales) of the EV sooner than expected. R2 production is now slated to begin in the first half of 2026, instead of the second half of 2026 (as had previously been promised). This will make it easier for Rivian to reach the production stage for this vehicle… before the company runs out of cash.

Second – and related to the first – because Rivian has decided to postpone construction of its Georgia factory for the time being, this allows it to conserve cash and further ensure that the cash it has will last from now until 2026. Georgia still remains part of Rivian’s long-term plan, and will be key to increasing production rates once R2 has been introduced and begun selling. But in the meantime, while the second factory is not being built, Rivian will be able to reduce its capital spending over the next couple years by about $2.25 billion.

Investors clearly liked the sound of all this, which is why they bid up Rivian stock so sharply – and Delaney seemed pleased as well. Running down the featured attractions of the R2 (including faster acceleration, a driving range comparable to most of its direct competitors, and a $45,000 base price that is only about 60% the price of Rivian’s existing R1 EVs), Delaney hypothesized that the R2’s introduction will “materially expand Rivian’s total addressable market” – perhaps by a factor of as much as 4x.

All that being said, and although Delaney sees all of the above as “an incremental positive for the stock,” after the recent stock price surge it may already be priced into Rivian stock. As a result, when all’s said and done, Delaney is leaving his recommendations on Rivian stock unchanged: A “neutral” rating, and a $13 target price that sees no more than 2% upside in the shares for the next 12 months.

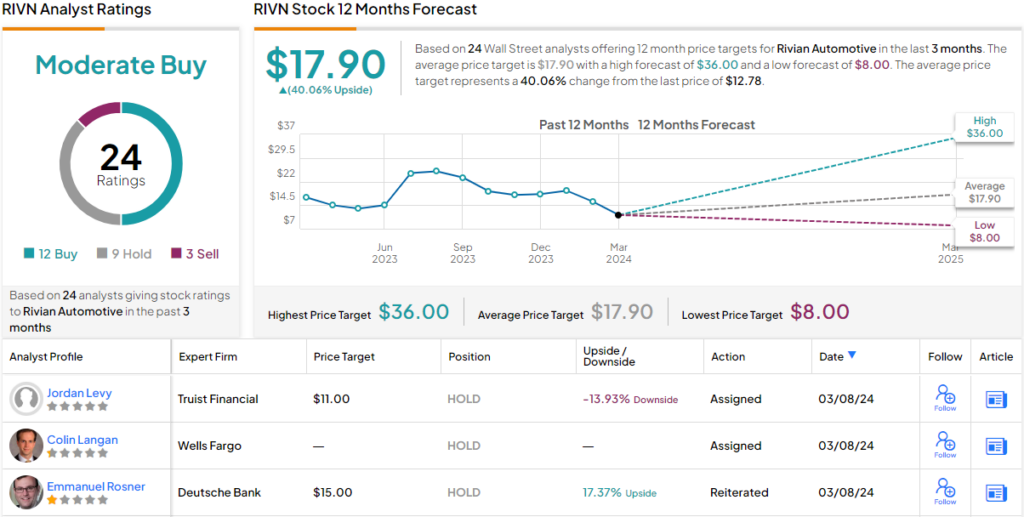

So, that’s Goldman Sachs’ view, let’s turn our attention now to rest of the Street: RIVN’s 12 Buys, 9 Holds and 3 Sells coalesce into a Moderate Buy rating. There’s a considerable upside potential – 40% to be exact – should the $17.90 average price target be met in the next 12 months. (See RIVN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.