Goldman Sachs Group (GS) plans to invest between $2 billion and $3 billion in the real estate sector of India over the next three years, a report published by MoneyContol.com said, citing people familiar with the matter.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The plan comes amid a revival in the Indian residential real estate market. The company has been a slow investor in this sector since the global financial crisis in 2007-08.

Goldman’s shares closed 1.2% lower on Friday at $382.73. Headquartered in New York City, the company offers investment management, securities, asset management, brokerage, and securities underwriting services.

Plan Details

The plan forms a part of Goldman’s aim to invest $30 billion in alternative investments in Asia over the next five years.

It has hired U.K.-based investment firm Actis’ Director Mukesh Tiwari to lead its Indian real estate investments. (See Insiders’ Hot Stocks on TipRanks)

Further, the company is in discussions with a Mumbai-based real estate developer for commercial and residential property and two developers in Bengaluru for platform deals.

Comments

A source said, “They (Goldman) have been doing mostly credit deals in real estate in the last two or three years. Now, they want to do both equity and debt with a focus on high-yield products.”

“They are pioneers in setting up data centers in Australia and they plan to do it with a strategic player in India,” another source said.

Bloomberg Report

According to a report published by Bloomberg recently, as part of its alternative investment plans for Asia, the company intends to boost its presence in South Korea, China and India.

Analysts’ Recommendation

Overall, the stock has a Strong Buy consensus rating based on 11 Buys and 2 Holds. The average Goldman Sachs Group price target of $464.15 implies 21.3% upside potential. Shares have gained 60.5% over the past year.

Website Traffic

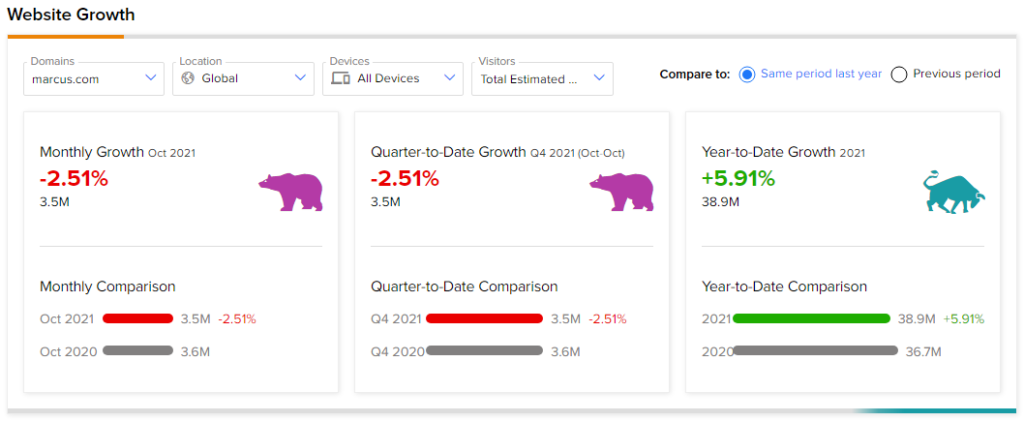

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Goldman’s performance.

According to the tool, compared to the previous year, the company’s website traffic registered a 2.5% decrease in global visits in October. However, the website traffic has increased nearly 6% year-to-date against the same period last year.

Related News:

Musk Sells Another $1B Worth of Tesla Shares — Report

Carlyle Group Acquires Minority Stake in Resonetics for $2.25B

Hibbett Sports Posts Q3 Beat; Shares Down 4.3%