Goldman Sachs Group, Inc. (GS) delivered outstanding third-quarter results aided by continued momentum in global mergers & acquisitions (M&A) activity, equity and equity-related offerings, debt underwriting, and Initial Public offerings (IPO). Additionally, the firm’s assets under management (AUM) grew to $67 billion, including long-term net inflows of $49 billion, to $2.37 trillion at quarter-end. Shares of the global financial institution jumped 3.8% on the news, closing at $406.07 on October 15.

The company reported earnings of $14.93 per share, up 66% year-over-year, and significantly outpaced analyst estimates of $10.11 per share.

To add to that, net revenue climbed 26% year-over-year to $13.61 billion and also surpassed Street estimates of $11.67 billion.

Revenue growth was attributed to strength in Financial advisory, continued strength in Underwriting, solid equity financing net revenue, and Fixed Income, Currency, and Commodities (FICC) financing revenue. Furthermore, the firm’s headcount grew 5% to 43,000 employees compared to the year-ago period.

Commenting on the results, David M. Solomon, Chairman, and CEO of GS, said, “The third quarter saw strong operating performance and an acceleration of our investment in the growth of Goldman Sachs. We announced two strategic acquisitions in our Asset Management and Consumer businesses which will enhance our scale and ability to drive higher, more durable returns.”

Mr. Solomon added, “Looking forward, the opportunity set continues to be attractive across all of our businesses and our focus remains on serving our clients and executing our strategy.”

During the quarter the firm returned $1 billion to common shareholders in the form of share repurchases and $700 million in common stock dividends. (See Insiders’ Hot Stocks on TipRanks)

Additionally, on October 13, the firm’s Board declared a quarterly common dividend of $2.00 per share to be paid on December 30 to shareholders of record on December 2.

In response to GS’s strong financial performance, Jefferies analyst Daniel Fannon maintained a Buy rating on the stock with a price target of $450, implying 10.8% upside potential to current levels.

Fannon was impressed by the solid revenue growth in both GS’s Investment Banking and Global Management segments and the overall strong momentum across all segments.

Overall, the stock commands a Strong Buy consensus rating based on 8 Buys and 1 Sell. The average Goldman Sachs price target of $446.56 implies 10% upside potential to current levels. Shares have gained 97.4% over the past year.

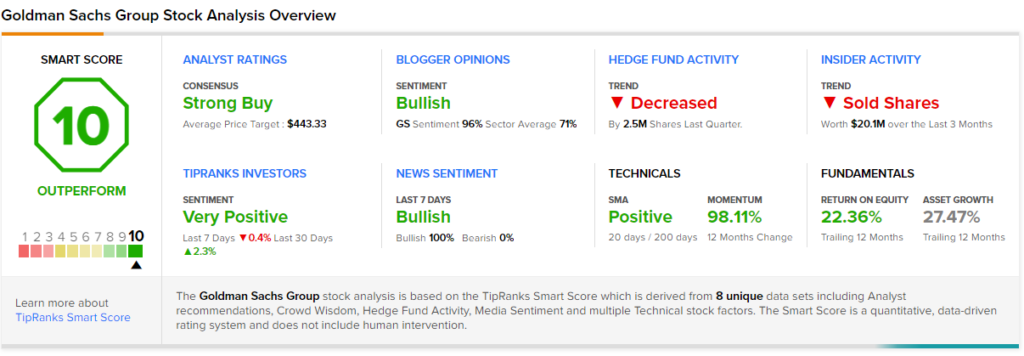

Furthermore, Goldman Sachs scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Delta Air Lines Exceeds Q3 Expectations; Shares Sink 6%

Poshmark Buys Suede One to Authenticate Sneakers; Shares Jump 6.7%

Commercial Metals Announces $350M Share Buyback, Hikes Dividend by 17%