On Monday, investment bank Goldman Sachs (NYSE:GS) announced an agreement to sell its Personal Financial Management (PFM) unit to a Kansas-based independent wealth management firm Creative Planning LLC. The transaction, which is expected to close in the fourth quarter of 2023, is part of the company’s strategy to scale back its presence in the consumer banking business and focus on ultra-high net worth customers.

Creative Planning is a Registered Investment Advisor (RIA), having over 2,100 employees across its affiliates and $245 billion in combined assets under management.

Goldman Sachs Revamps Strategy

The news of the sale comes days after the bank said that it was evaluating alternatives for its investment adviser or PFM business. Goldman said that the PFM unit is a “very small” part of its wealth management business. The PFM unit was formed when Goldman acquired a team of about 220 financial advisors managing $25 billion in assets in May 2019, through the $750 million acquisition of United Capital Financial Partners.

Goldman Sachs expects the sale of the PFM unit to Creative to result in a gain, though the company didn’t disclose the financial terms of the deal. Further, the PFM unit sale is expected to be margin accretive to the Asset and Wealth Management division. The deal would help the company focus on the ultra-high net worth wealth management clients, while serving the high-net worth investors through RIAs like Creative Planning.

Goldman’s foray into mass-market or consumer banking impacted its profitability, drawing criticism from within the company for its CEO David Solomon. Aside from PFM, the bank previously announced plans to sell its fintech business GreenSky, which was acquired in 2021. On Tuesday, Bloomberg reported that discussions about the sale of GreenSky are in the final stages, with groups comprising Apollo Global Management Inc., Pagaya Technologies Ltd., and Sixth Street working on their best and final proposals.

At the investor day held earlier this year, Goldman Sachs discussed its plans to continue to grow its proprietary wealth channels, including its Private Wealth Management unit, workplace financial planning offering Ayco, the related private banking and lending business, and its Marcus Savings offering. The company’s private wealth unit oversees $1 trillion in assets and serves ultra-high net worth clients having $60 million or more in investable assets.

Is GS a Good Stock to Buy?

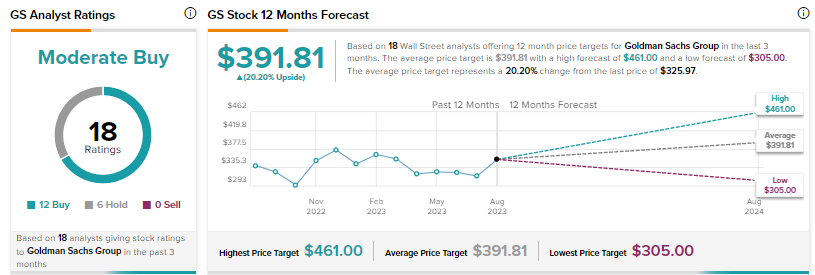

With 12 Buys and six Holds, Goldman Sachs scores a Moderate Buy consensus rating. The average price target of $391.81 implies 20.2% upside potential. Shares have declined 5% year-to-date.

Investors should note that Credit Suisse analyst Susan Roth Katzke is the most accurate analyst for GS stock, according to TipRanks. Copying her trades on GS and holding each position for one year could result in 68% of your transactions generating a profit, with an average return of about 18% per trade.