Goldman Sachs raised Peloton Interactive’s price target to $96 (26.4% upside potential) from $84 saying that the Street is underestimating the company’s growth potential. Shares rose 8.1% on Friday.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

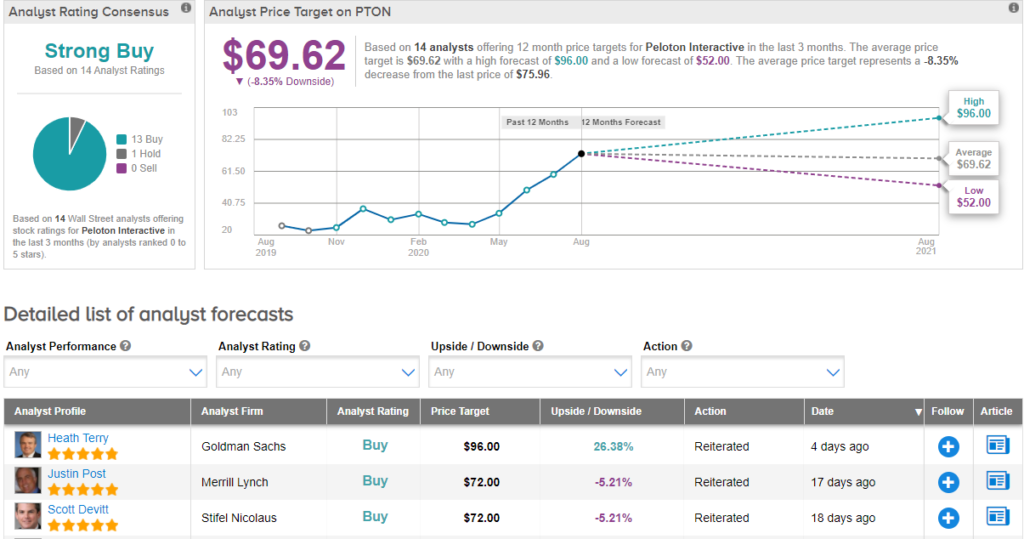

Goldman Sachs analyst Heath Terry reaffirmed his Buy rating on Peloton (PTON) saying that he expects the fitness product maker to surpass analysts’ forecast for new subscriber additions in 4Q. Terry believes that the company will add 208,000 new subscribers while the Street is forecasting 199,000 new subscribers.

Pelton has been benefiting from a surge in demand for fitness services and products as consumers look to stay fit amid COVID-19 pandemic-led shelter-in-place directives. In 3Q, the company added 176,600 paying subscribers, representing a 64% year-over-year growth. (See PTON stock analysis on TipRanks).

Currently, Wall Street analysts have a bullish outlook on the stock. The Strong Buy analyst consensus is based on 13 Buys and 1 Hold. With shares down about 168% year-to-date, the average price target of $69.62 implies downside potential of 8.4% to current levels.

Related News:

Hibbett Jumps 8% On Upbeat 2Q Results

Morgan Stanley Downgrades DraftKings On Competitive Headwinds

Dollar General Exceeds Estimates On Solid Same-Store Sales