When it rains, it pours. In the world of commodities, this week has brought its share of storms. Gold and oil plummet as market panic hits hard. Gold (CM:XAUUSD) prices fell over 2% on Monday, dropping to $2,393.66 per ounce, as a broad selloff in equities rattled investors. Meanwhile, oil also took a hit, with Brent crude (CM:CL) slipping to $76.05 per barrel amid recession fears and ongoing supply concerns from Libya.

Gold’s Unsettled Waters

Gold, traditionally seen as a safe haven, didn’t escape the market chaos unscathed. On Monday, the yellow metal took a dive, dropping 2% amid a flurry of market activity. “There’s some truth in the old chestnut that all correlations go to one in a crash,” says Adrian Ash, director of research at BullionVault. This reflects how even gold, often considered a bastion of stability, can be affected when investors rush to liquidate positions in a turbulent market.

Despite this recent dip, gold’s appeal as a safe haven remains strong. According to Reuters, analysts like Han Tan from Exinity Group believe that gold is likely to rebound. “Elevated geopolitical tensions and hopes for further Fed rate cuts should create supportive conditions for bullion,” Tan notes. Gold has been buoyed by fears of a U.S. recession and low interest rates, which generally support the price of the yellow metal. In fact, gold prices briefly hit record highs above $2,500 an ounce earlier this year, reflecting its role as a refuge during economic uncertainty.

Oil’s Slippery Slope

Oil, too, is navigating choppy waters. Brent crude futures fell to $76.05 per barrel, while U.S. West Texas Intermediate (WTI) crude dropped to $72.75. The declines come amid fears of a U.S. recession that has prompted investors to flee riskier assets. But the drop in oil prices isn’t just about economic worries. Supply concerns are also at play.

Libya’s largest oil field, Sharara, has been hit by local protests that have led to a complete halt in output. This has added a layer of complexity to the oil market, even though prices are down. “Supply concerns are limiting losses,” says IG market analyst Tony Sycamore. Additionally, geopolitical tensions in the Middle East, including ongoing conflicts and the risk of further escalation, are keeping a lid on how low oil prices can go.

Looking Ahead

Both gold and oil are navigating a rough patch, with market dynamics shifting rapidly. For gold, its long-term safe-haven status means it could recover as market conditions stabilize. For oil, the balance between supply disruptions and recession fears will likely determine the next moves.

What Is the Outlook for Gold?

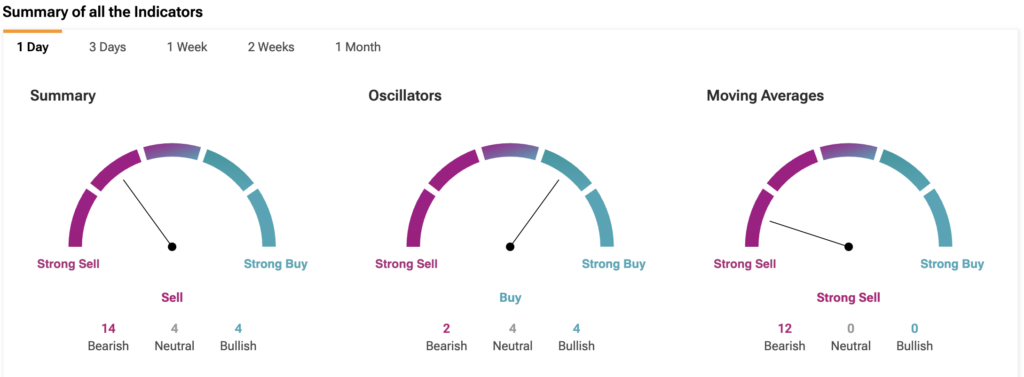

The TipRanks Technical Analysis tool is flashing a Strong Buy signal for gold on a daily timeframe. This means traders could consider using any price dips to go long on gold.

What Is the Outlook for Oil?

Meanwhile, the TipRanks Technical Analysis tool is flashing a Sell signal for oil on a daily time frame. This means the price action in oil could continue to weaken over the coming sessions.

Ready to “commodi-tize” your knowledge? Click here to dive into the world of commodities on TipRanks