Building products distributor GMS Inc. (GMS) has successfully completed the acquisition of interior building materials supplier Westside Building Material for $135 million.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

GMS’ product offerings include suspended ceilings systems, wallboard, and complementary construction products. Meanwhile, California-based Westside supplies ceiling systems, interior/exterior walls, and related construction products.

President and CEO of GMS, John C. Turner Jr., said, “Westside significantly increases our reach in several major California markets and represents our first foray into the Las Vegas market. Expanding our geographic platform through accretive acquisitions, such as this one, continues to be a vital component of our strategic growth priorities.”

The company’s shares closed 1.8% lower at $48.12 on Friday. (See GMS stock chart on TipRanks)

Barclays analyst Matthew Bouley recently reiterated a Hold rating but raised the price target to $49 (1.8% upside potential) from $37. In a research note to investors, the analyst said that the company’s current valuation might include the recovery in the non-residential sector.

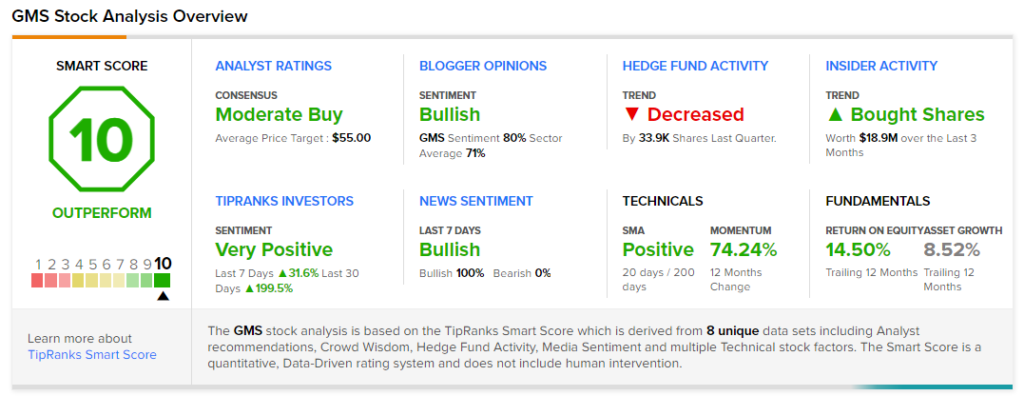

Overall, the stock has a Moderate Buy consensus rating based on 4 Buys and 2 Holds. The average GMS price target of $55 implies 14.3% upside potential from current levels. The company’s shares have gained 101.7% over the past year.

According to TipRanks’ Smart Score rating system, GMS scores a “Perfect 10”. This suggests that the stock is likely to outperform market averages.

Related News:

Sun Life Closes PinnacleCare Acquisition

MarineMax Snaps Up Nisswa Marine, Deepens Presence in Midwest

Hims & Hers Launches Online Mental Health Therapy; Street Says Buy