Meme stocks including Bed Bath & Beyond (BBBY), AMC (AMC), and GameStop Corp.(GME) surged in pre-market trading on Wednesday boosted by GME’s huge earnings surprise.

GME reported a quarterly profit for the first time in two years of $48.2 million, or $0.16 per share, compared to a loss of $147.5 million, or $0.49 per share in the same period a year back. The retailer achieved this in part by slashing costs as selling, general and administrative expenses came in at $453.4 million for the quarter versus $538.9 million in the same period last year.

As GME swung to a profit, there has been rising speculation that this could set up the stock for another rally which could force short sellers to drop their bets against the company resulting in a “short squeeze.” A short squeeze happens when a heavily shorted stock results in short sellers exiting their positions in the stock which only drives up the price further.

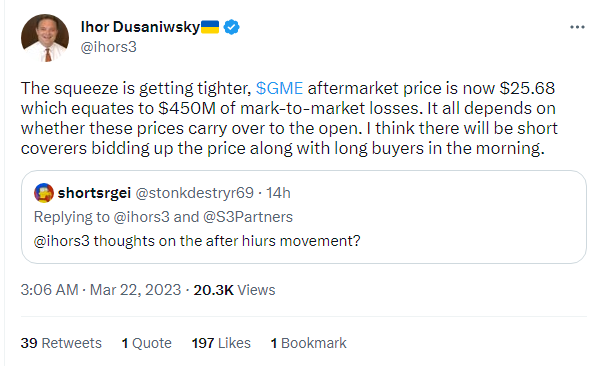

Ihor Dusaniwsky of S3 Partners tweeted about the after-hours rally for GME following the results,

When Dusaniwsky was asked whether AMC is also up for a short squeeze, Dusaniwsky termed AMC as a “crowded short” and added,

Currently, short interest in AMC stands at 125.96 million while it stands at 56.85 million for GME.

For investors interested in getting an exposure to meme stocks, the Roundhill MEME ETF (MEME) is a good option. The ETF has soared by more than 18% in the past three months.