The latest from the United Auto Workers (UAW) strike isn’t looking good, at least not all over. Yet despite this, gains are still being realized. Both Ford (NYSE:F) and General Motors (NYSE:GM) are up fractionally in Friday morning’s trading despite being hit harder by the UAW. On the other hand, Stellantis (NYSE:STLA) is said to be making progress but is down fractionally in Friday’s trading.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

The UAW called for new walkouts at Ford and GM plants, with Ford losing its Chicago assembly plant and GM losing a plant in Michigan’s capital city Lansing. Stellantis, however, was spared, as there was “significant progress” made on those labor talks. Cost-of-living adjustments and some other benefits were apparently souped up to the point where the UAW could live with what came out therein. Right now, union members engaged in walkouts are being kept on track by a roughly $800 million reserve fund in the UAW’s hands, which will pay $500 a week to picketing workers.

UAW’s current rate of consumption is about $8 million per week, given the current levels of picketing, which suggests that the UAW can keep going somewhat longer than its employers can survive without production. This is especially true given what we saw only yesterday about issues of perception for car shoppers. With a range of reputational points on the line for the Big Three automakers, reaching a satisfactory conclusion becomes all the more crucial. And with reports noting that GM only has about two weeks to negotiate a contract in Canada, it makes reaching that conclusion more vital still.

Which Auto Maker Stocks are Good Buys Right Now?

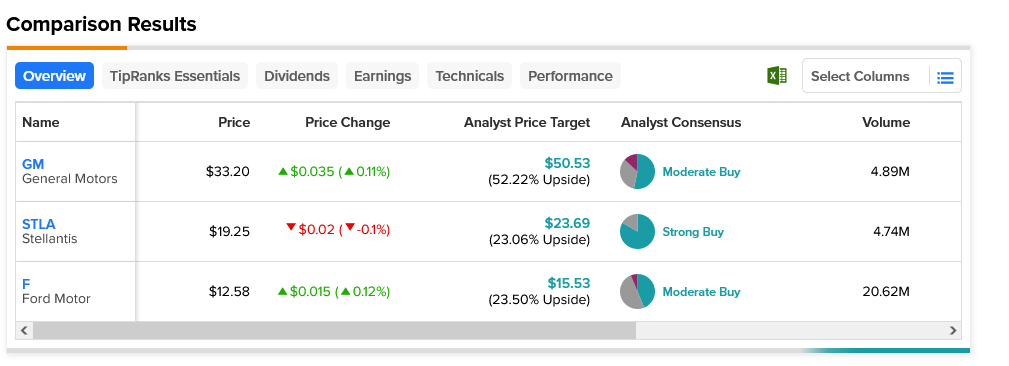

Right now, General Motors still carries the strongest upside potential out of the three auto stocks. With an average price target of $50.53, this Moderate Buy carries 52.22% upside potential. Meanwhile, Stellantis still has the lightest upside, with a $23.69 average price target yielding 23.06% upside potential.