General Motors Co. (NYSE:GM) gained in pre-market trading after the company raised its Fiscal year 2024 (FY24) forecast and delivered an earnings beat in Q1. The company now expects FY24 adjusted earnings in the range of $12.5 billion to $14.5 billion, up from its prior forecast between $12 billion and $14 billion. The automobile major has forecasted adjusted earnings in the range of $9 to $10 per share, up from its prior outlook between $8.50 and $9.50 per share.

GM’s Q1 Numbers

In the first quarter, GM reported adjusted earnings of $2.62 per share, compared to $2.21 in the same period last year, which surpassed consensus estimates of $2.04 per share. The company generated revenues of $43 billion in the first quarter, marking an increase of 7.5% year-over-year, and beating Street estimates of $40.7 billion.

In addition to this, GM announced a quarterly dividend of $0.12 per share payable on June 20 to all common shareholders of record, as of the close of trading on June 7, 2024.

Is GM a Good Stock to Buy?

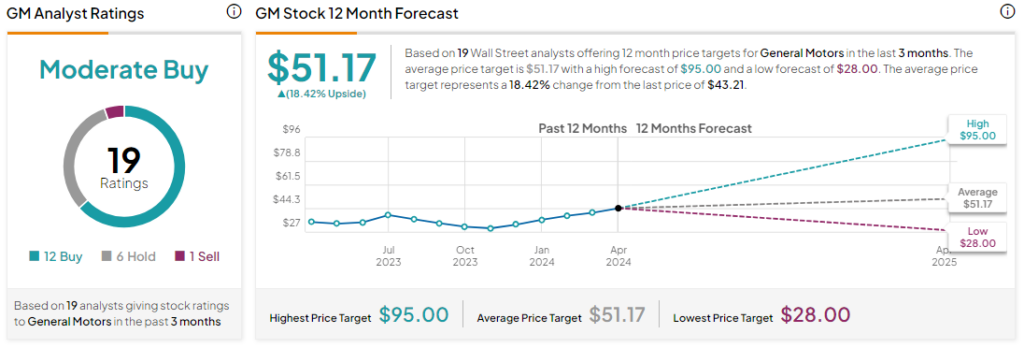

Analysts remain cautiously optimistic about GM stock, with a Moderate Buy consensus rating based on 12 Buys, six Holds, and one Sell. Over the past year, GM has soared by more than 25%, and the average GM price target of $51.17 implies an upside potential of 18.4% from current levels. These ratings are likely to change following GM’s Q1 results today.