Zalando SE (DE:ZAL) is a German online retail company that provides clothing, footwear, and accessories to millions of customers in 15 countries in Europe. The company’s stock has experienced a significant decline of 28% over the past year. In a wider span of three years, the investors are facing a loss of almost 60%.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Similar to its counterparts in the retail industry, Zalando is also facing pressure from rising inflation, which is impacting overall demand. The sales were also impacted once the pandemic subsided and shoppers resumed in-store shopping.

Q1 2023 Earnings

In May, the company reported its first-quarter earnings for 2023. The company posted a growth of 2.3% in its revenues of €2.6 billion, driven by its discounts and offers on its premium brands through its shopping club lounge. The company is on track towards profitability, as it reached a break-even point in its earnings, compared to a loss of €52 million in Q1 2022.

Moving forward, Zalando confirmed its full-year guidance where its revenue is expected to grow up to 4%. The company anticipates that the adjusted EBIT for 2023 will range between €280 million and €350 million.

Analysts’ View

Yesterday, J.P. Morgan analyst Georgina Johanan confirmed her Hold rating on the stock, showing her cautious approach to the company’s next set of results. According to Johanan, the internet traffic data indicates a deceleration in business growth for Zalando in Germany.

On the contrary, analysts from RBC Capital and Warburg Research are bullish on the stock and reiterated their Buy ratings after Q1 results. Sherri Malek from RBC has a price target of €50 for the stock, which implies an upside of 94%.

Jorg Philipp Frey from Warburg assigned a Buy rating on the stock 28 days ago. He predicts more than 100% growth in the share from the current trading level.

Zalando Share Price Target

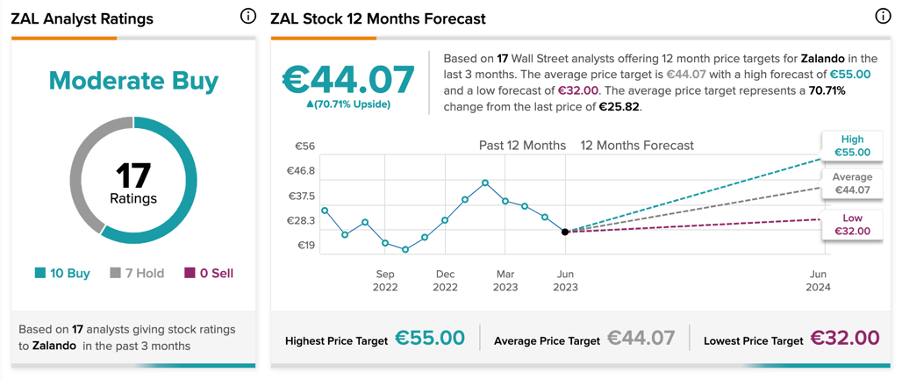

According to TipRanks’ rating consensus, ZAL stock has a Moderate Buy rating backed by a total of 17 recommendations. It includes 10 Buy and seven Hold ratings.

The average price forecast is €44.07, which shows a huge upside of 70.8% in the share price.

Conclusion

The company’s management is optimistic about navigating the challenges and continuing its robust performance. Analysts, however, have mixed opinions and expect some friction in the short term.

Overall, the stock is rated as Moderate Buy and could be a good addition for investors in the long run.