Chinese electric vehicle (EV) maker XPeng (HK:9868) seeks to expand its workforce by 4,000 this year, as indicated in an internal letter from CEO He Xiaopeng to employees on Sunday. The company is increasing its headcount to support its ambitious growth plans, which include the launch of about 30 new and revamped models over three years.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

XPeng’s Growth Plans

Xiaopeng said that, unlike various business partners who are sceptical about investing due to the current macroeconomic situation, he sees an opportunity for the company’s development. The CEO thinks that the company will “buck the trend and enter a high-speed positive cycle in the fourth quarter or earlier.”

XPeng’s strategy contrasts several Chinese EV players that are reducing costs and trimming their employee count due to the ongoing macro challenges. Given the intense competition in the Chinese EV market, many players are focusing on opportunities in Europe and other international markets.

Aside from expanding its workforce, XPeng intends to boost its research and development (R&D) spending by over 40% to ensure competitiveness. In particular, it plans to invest RMB 3.5 billion in artificial intelligence (AI) R&D for intelligent driving.

Like other EV players, XPeng is also under pressure due to a price war triggered by Tesla (NASDAQ:TSLA). Xiaopeng thinks that the fierce rivalry in the EV space may end in a “bloodbath” this year. However, he is optimistic about XPeng’s prospects, with the company gearing up to launch its first models in the price category of more than RMB 300,000 and those in the RMB 150,000 range.

What is the Target Price of XPeng?

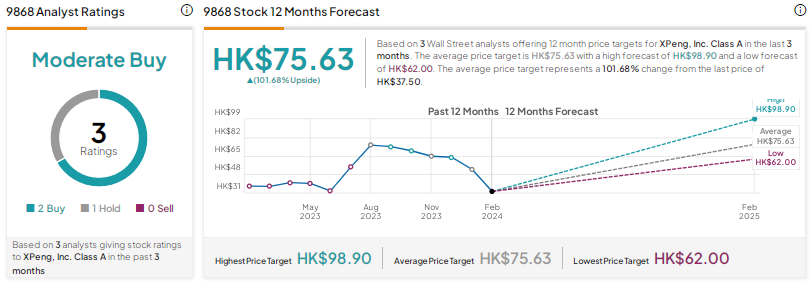

XPeng stock scores a Moderate Buy consensus rating based on two Buys and one Hold. The XPeng Inc. share price target of HK$75.63 implies 102% upside potential. Shares have retreated more than 4% in the past year.