The share price of WuXi Biologics (Cayman), Inc. (HK:2269) remains under pressure as analysts trimmed their price targets in reaction to the company’s guidance cut. The company revised its annual revenue growth outlook to 10%, reflecting a sharp decline from the previous guidance of 30% due to a slowdown in funding, resulting in delays in major projects.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

WuXi Biologics is a prominent open-access technology platform that provides comprehensive solutions to enable organizations to discover, develop, and manufacture biologics.

Weak Guidance Weighs on WuXi Biologics’ Shares

WuXi now anticipates its sales target for the year to fall short by approximately $400 million due to reductions in its development and manufacturing services.

The stock has lost 30% of its value so far this week, including a temporary halt in trading after a big drop on Monday. WuXi stock recovered a little and ended today at a gain of 1.15%. Year-to-date, the stock has witnessed a decline of about 50% in its value, reflecting industry-wide challenges as the COVID-related surge begins to disappear.

Analysts’ Reactions

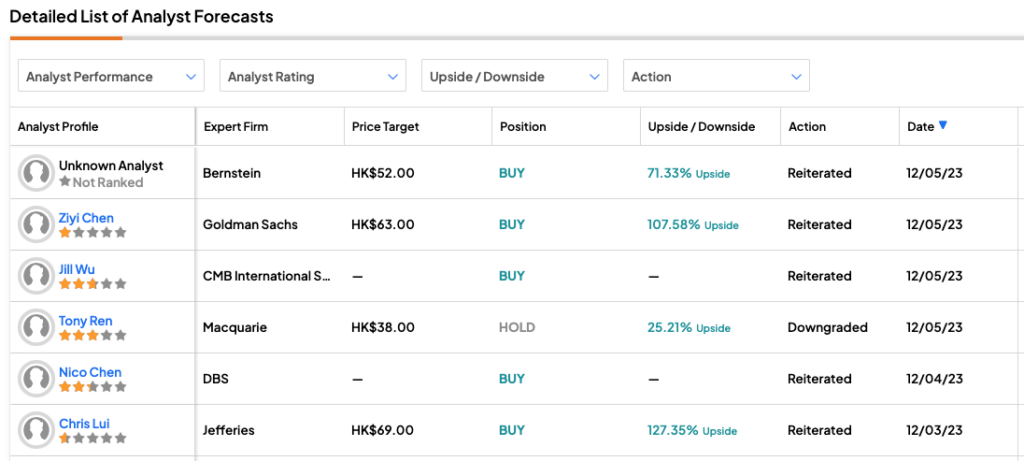

Analysts from firms, including Jefferies, Goldman Sachs, and Macquarie, have reduced the price forecast for WuXi stock over the last three days. Several analysts have also adjusted revenue and profit projections for the company, reducing their forecasts through 2025. However, most analysts have maintained their Buy rating on the stock, considering the company’s strong fundamentals.

Earlier this week, analyst Chris Lui from Jefferies reiterated his Buy rating on the stock while slightly reducing the price target to HK$69 from HK$90. He expects short-term volatility around the stock due to turnaround expectations and macro factors. Nonetheless, he believes the stock is set to rise in the second half of 2024 after all the noise from the upcoming U.S. election fades away.

Lui called the stock “one of the best risk/reward profiles among Chinese healthcare stocks.”

Macquarie analyst Tony Ren also reduced the price target from HK$52.0 to HK$38 while downgrading his rating on the stock from Buy to Hold.

On the other hand, DBS analyst Nico Chen is bullish on the stock and expects significant earnings growth in the second half of FY23, attributing it to market recovery and a project mix that may lead to higher earnings.

WuXi Bio Share Price Forecast

As per TipRanks, 2269 stock has received a Strong Buy consensus rating, supported by five Buys and one Hold recommendation. The WuXi Bio share price forecast stands at HK$55.49, signifying a potential upside of about 83% from the current level.