WTI Crude Oil (CM:CL) closed lower in Wednesday’s trading, falling $0.27 to settle at $81.35 per barrel. This comes after some negative news. Indeed, the Energy Information Administration (EIA) released its weekly Crude Oil Inventories report, which measures the weekly change in the number of barrels of commercial crude oil held by U.S. firms.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Compared to last week, inventories increased by 3.165 million barrels. For reference, economists were expecting a decrease of -0.7 million barrels week-over-week. This means that demand was weaker than anticipated. In addition, the U.S. dollar (DXY) is seeing some strength ahead of this week’s Personal Consumption Expenditures (PCE) report, which is adding to the pressure on oil.

Oil Technical Analysis

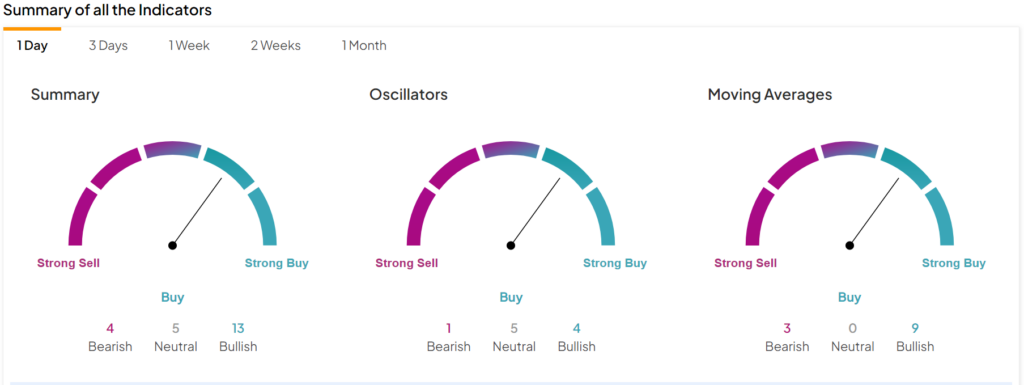

Using TipRanks’ technical analysis tool, the indicators seem to point to a positive outlook for oil. Indeed, the summary section pictured below shows that 13 indicators are Bullish, compared to five Neutral and four Bearish indicators.

Here is a list of energy stocks that can be influenced by the latest developments in the energy markets.