The mega-merger talks between Australian energy giants Woodside Energy Group (AU:WDS) and Santos Ltd (AU:STO) have fallen apart. As per sources familiar with the matter, Woodside didn’t give a firm offer even after months of due diligence. Meanwhile, Santos’ board found that the merger was not in the best interest of shareholders. The two companies were unable to agree on a win-win valuation level. STO stock plunged nearly 6% on the news, while WDS shares were up about 1% today.

Here’s Why Both Companies Backed Off

Woodside CEO Meg O’Neill said that despite the failed merger talks, he sees the LNG (liquefied natural gas) sector playing a significant role in the global energy transition and hence, believes that it “provides significant potential for value creation.” Woodside reportedly faced pressure from certain investors who urged the company not to pay a premium price for Santos.

Meanwhile, Santos noted that after thorough deliberation, the company realized that the combined benefits did not support the merger thesis and were not in the best interest of its shareholders. The company added that it would continue to undertake a strategic review of its business to navigate the current challenges. Experts think that Santos needs to consider selling its 51% stake in the Pikka oil project in Alaska to boost its liquidity.

The proposed merger could have formed an AU$80 billion oil and gas giant with a strong foothold in the LNG segment. Woodside and Santos expected the combined company to draw huge demand globally, as LNG is seen as a popular alternative fuel to meet the world’s decarbonization goals.

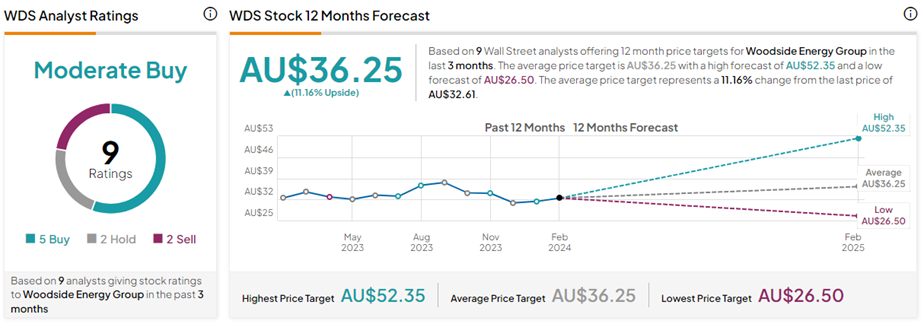

Is Woodside Energy a Good Stock?

On TipRanks, WDS stock has a Moderate Buy consensus rating based on five Buys, two Holds, and two Sell recommendations. The Woodside Energy Group share price target of AU$36.25 implies 11.2% upside potential from current levels.

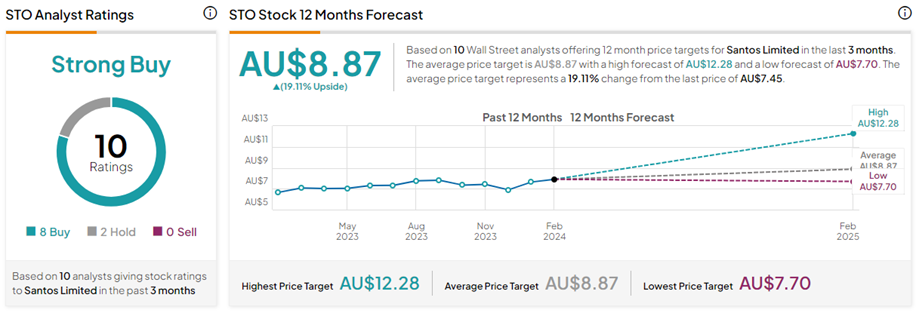

Are Santos Shares a Good Buy?

With eight Buys and two Hold ratings, STO stock commands a Strong Buy consensus rating on TipRanks. The Santos Ltd share price forecast of AU$8.87 implies 19.1% upside potential from current levels.