Singapore Airlines (SG:C6L) is the flagship airline of Singapore and is among the best airlines in the world. On May 16, the company reported its 2023 earnings report with record profit numbers. Following the release of the results, the company’s stock experienced a significant surge, reaching its highest level since February 2020. YTD, the stock has gained 23.86%.

In 2023, the airline made an annual profit of S$2.16 billion, marking a turnaround after three consecutive years of losses. The reopening of borders led to robust air travel demand, resulting in increased revenue, operating profit, and passenger load factor. The company’s passenger load factor reached an all-time high of 85.4%, surging by an impressive 55.3%.

Moving forward, the company believes the outlook for air travel demand remains strong, supported by the recovery of air travel in East Asia. Furthermore, forward sales across all cabin classes continue to show positive momentum, particularly with an impressive increase in bookings to China, Japan, and South Korea.

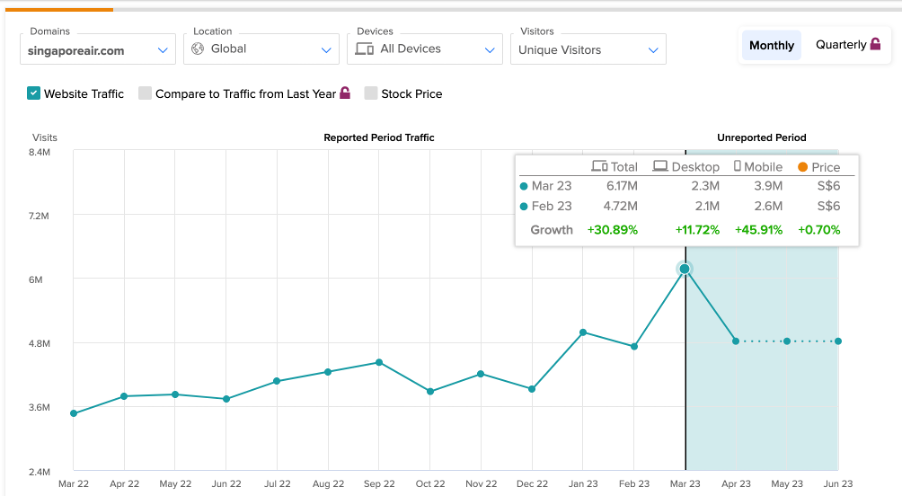

Website Traffic

As per the TipRanks Website Traffic Chart, Singapore Airlines reported a 30.8% growth in March 2023 with 6.17 million unique visitors. In April, this figure was down by 22% to 4.82 million visitors. Looking at the YTD figures, the airlines witnessed a growth of 68.5% with 20.7 million visitors.

By utilizing this tool, investors can acquire valuable insights into the performance and growth of the company’s website, which can be compared over various time periods. Furthermore, this tool allows investors to gather data on website traffic and correlate it with stock price movements, facilitating the evaluation of future performance.

Singapore Airlines Stock Forecast

According to TipRanks’ analyst consensus, C6L stock has a Moderate Buy rating. The company has a total of six ratings, including three Buy and there Hold recommendations.

The average price target is S$6.47, which is 4.8% lower than the current price level.

Concluding Thoughts

In anticipation of the summer holiday season, Singapore Airlines anticipates a further rise in demand from travelers. The company’s growing website traffic and robust operational performance serve as positive indicators, suggesting a promising path to recovery.