Shares of Australia-based conglomerate Wesfarmers Limited (AU:WES) reached a new 52-week high of AU$62.11 after reporting solid profits for the first half of Fiscal 2024, ending December 31, 2023. The company’s net profit after tax increased 3% year-over-year to AU$1.43 billion, ahead of analysts’ expectations of about AU$1.40 billion. WES shares rose 5% today.

Wesfarmers is an industrial and retail conglomerate that operates retail chains like Bunnings hardware stores and Kmart discount stores. It also comprises fertilizer, healthcare, and lithium businesses.

Wesfarmers’ First-Half Performance

Wesfarmers’ revenue grew 0.5% to AU$22.67 billion, driven by higher revenue from Bunnings Group, Kmart Group, Officeworks, and the Industrial and Safety division. However, a 21% decline in the revenue from the chemicals, energy, and fertilizer unit (WesCEF) weighed on the company’s overall top-line growth. The decline in commodity prices amid a weak demand environment impacted the WesCEF unit.

Wesfarmers highlighted the strong performance of its retail divisions, which attracted customers through their value deals in a high-inflation backdrop. Remarkably, the company’s operating cash flows surged 47% to nearly AU$3.0 billion, driven by favourable working capital movements and the Kmart Group’s solid earnings growth.

Higher profits and robust cash flows helped the company announce a 3.4% year-over-year rise in its interim dividend to AU$0.91 per share.

While the company did not provide any specific outlook, it stated that the Kmart Group continued to maintain its strong sales momentum in the first five weeks of the second half of Fiscal 2024. Also, Bunnings’ sales growth was broadly in line with the performance in the first half. The company cautioned that the results of its industrial businesses will depend on international commodity prices, forex movements, competitive landscape, and seasonal factors.

Is Wesfarmers a Good Stock to Buy?

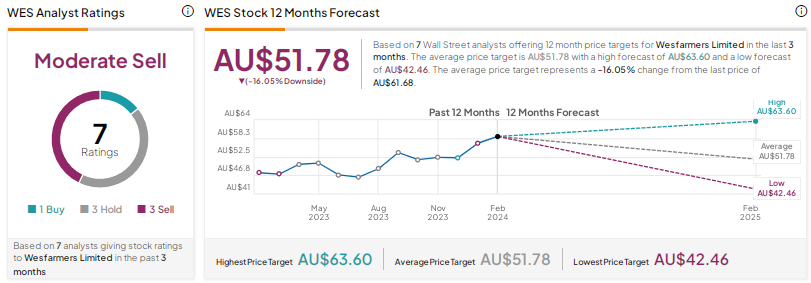

With one Buy, three Holds, and three Sells, WES stock has a Moderate Sell consensus rating on TipRanks. The Wesfarmers Limited share price target of AU$51.78 implies a possible downside of 16%. Shares have risen nearly 21% in the past year.