Britain’s multinational telecommunications company Vodafone Group plc (GB:VOD) has dismissed France-based telecom firm Iliad SA’s bid to unite their Italian units. VOD shares fell nearly 4% on the news as shareholders believed it was one of the most favorable scenarios to gain market leadership in Italy’s highly competitive telecom space.

Recently, Iliad had sweetened the original offer by €100 million, whereby Vodafone Italia would get €6.6 billion in cash and a €2 billion shareholder loan. At the same time, Iliad would get €400 million in cash and a €2 billion shareholder loan in the 50:50 partnership.

Details of the Dismissal

A Vodafone spokesperson confirmed that the company rejected Iliad’s offer, but talks with other potential buyers are ongoing. One of the potential suitors is Swisscom AG’s (DE:SWJ) Fastweb Italian unit, which sources suggest has bid an inferior proposal.

One of the reasons that could have led to Vodafone’s rejection is regulatory hurdles. Vodafone Italia and Iliad had higher chances of facing anticompetitive and monopolistic complaints. With Swisscom’s Fastweb, the potential for facing regulatory scrutiny is lower, which implies that a deal could soon be accomplished.

Meanwhile, irked by Vodafone’s dismissal, Iliad believes the company’s proposal was the “best possible business combination to benefit a struggling Italian market and telecommunications industry.” Iliad is charged up to face the competition alone and is confident that it can win a larger market share even as a standalone company.

Is VOD Stock a Good Buy?

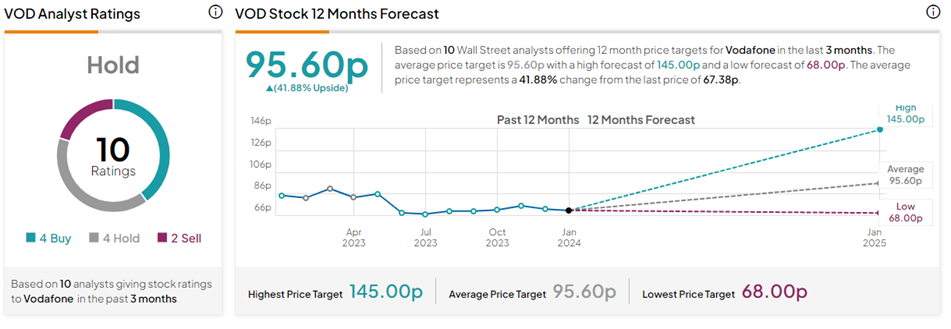

Following the news, Deutsche Bank analyst Robert Grindle cut the price target on VOD from 165p to 145p (115.2% upside) but maintained a Buy rating. Despite the share price cut, Grindle’s VOD price target remains the highest among the analysts tracked by TipRanks.

Overall, analysts prefer to remain on the sidelines as the uncertainty surrounding business strategies continues. On TipRanks, VOD stock has a Hold consensus rating based on four Buys, four Holds, and two Sell ratings. The Vodafone Group plc share price forecast of 95.60p implies 41.9% upside potential from current levels.