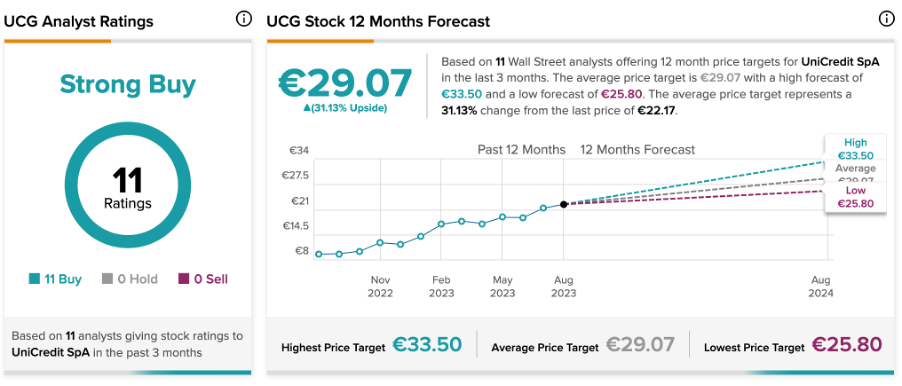

Italy’s leading banking group, UniCredit S.p.A. (IT:UCG), has recently received Buy ratings from analysts, suggesting more upside potential in the share price. Overall, the stock has earned a Strong Buy rating from analysts on TipRanks.

Over the last 12 months, the company’s stock has experienced a robust surge, recording a growth rate of 137%, of which 74% has been achieved YTD. The company’s solid operational performance, driven by higher interest income, has pushed the share price higher.

During this week, the shares experienced a setback following the Italian government’s introduction of a 40% windfall tax on banks’ profits derived from high interest rates. A windfall tax is a charge imposed by a government on companies that have experienced substantial profits due to external circumstances or events.

UniCredit’s shares declined by nearly 6% on Tuesday after the news announcement.

Headquartered in Italy, UniCredit is a banking group that provides a wide range of services across Europe. The bank caters to around 15 million customers worldwide.

What are the Results of UniCredit’s Q2?

Italian banks have recently announced Q2 earnings with robust numbers and also raised their guidance. In July, UniCredit reported net profits of €2.3 billion in the second quarter, which marked a growth of almost 15% from the previous year. The primary contributor to the growth in earnings was net interest income of €3.5 billion, which grew by a whopping 41.3% on a year-over-year basis. For the full year, the bank has projected a net interest income of €13.2 billion.

UniCredit has achieved numbers that will attract a windfall tax in 2023, which could be evident in the financial results of 2024. However, a part of this money will be returned to the banks to help their customers pay higher bills.

Analysts Still Remain Bullish

Analysts hold the perspective that the tax’s effect would be more pronounced on smaller banks. For big banks like UniCredit, investors are likely to fare well in the end, and they might capitalize on the present volatility to acquire shares at a cheaper price.

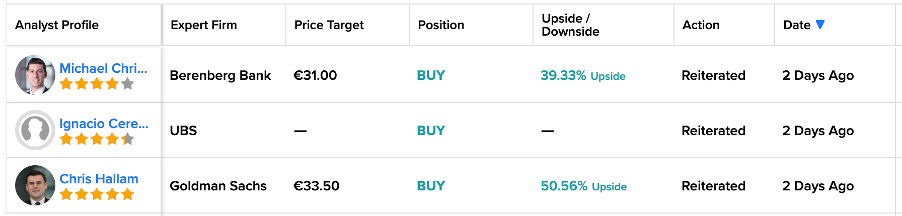

Two days ago, the stock garnered three Buy ratings from analysts, indicating that their faith in the stock remains unshaken despite the newly announced tax.

Berenberg Bank’s analyst Michael Christodoulou reiterated his Buy rating on the stock, predicting almost 40% growth in the shares.

Similarly, Chris Hallam of Goldman Sachs also recommended buying the stock, as he predicts an upside potential of 50% in the price.

UniCredit Share Price Target

UCG stock has a Strong Buy rating on TipRanks, backed by all Buy recommendations from 11 analysts. The average target price is €29.07, which represents a favorable change of over 30% in the share price.