In top news on UK stocks, Vodafone Group PLC (GB:VOD) has raised €1.7 billion from an 18% stake sale in India’s telecom tower company, Indus Towers Limited. The company sold 484.7 million shares through an accelerated book-build offering. Vodafone will use the gross proceeds to repay a significant amount to the company’s current creditors in connection with the €1.8 billion outstanding bank loans secured against its assets in India.

Following the news, Vodafone shares gained 0.74%, while NSE-listed Indus Towers is trading down by over 2% as of writing.

Based in the UK, Vodafone is a telecommunications company that offers various services, including voice, messaging, and internet connectivity across fixed and mobile networks.

Vodafone’s Stake Sale

Indus Towers is among the leading telecom infrastructure companies in the world. Vodafone has been gradually selling portions of its holdings in Indus Towers. After this recent transaction, Vodafone holds 82.5 million shares in Indus, resulting in a 3.1% stake, down from 42% in 2013. India-based Bharti Airtel Limited remains the largest shareholder in Indus Towers, with a 47.95% stake.

Vodafone has also streamlined its European portfolio through multiple divestments in Spain and Italy. In March, Vodafone sold its Italian business, Vodafone Italia, to Switzerland-based Swisscom AG (DE:SWJ) for €8 billion in cash. The company also announced plans to allocate €4 billion of the proceeds to share buybacks in FY25.

What is the Target Price for Vodafone PLC?

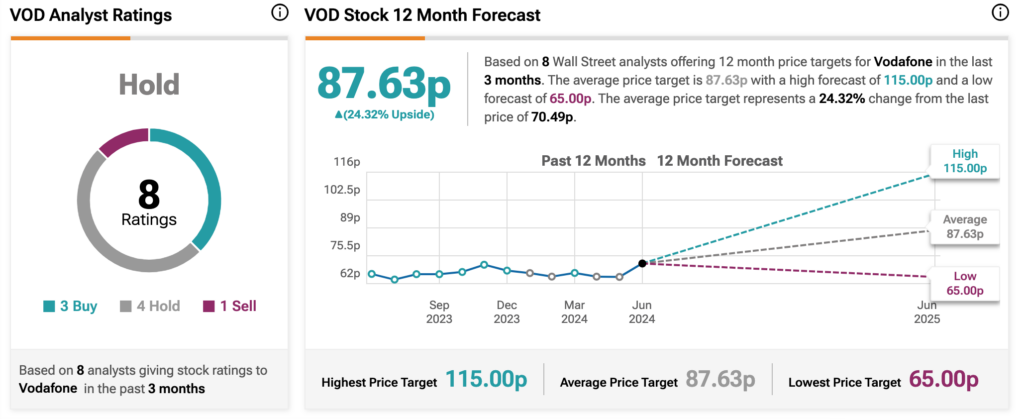

According to TipRanks, VOD stock has a Hold consensus rating based on three Buys, four Holds, and one Sell. The Vodafone share price target is 87.63p, which implies an upside of 24.3% on the current trading levels. The price target has a high forecast of 115p and a low forecast of 65p.