Among the major news on UK stocks, energy giant Shell (NYSE:SHEL) (GB:SHEL) halted construction at its Rotterdam biofuels facility in the Netherlands amid the ongoing slump in the European biofuel market. The pause aims to evaluate factors such as cost, delivery, and the most commercially viable path forward for the project.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

According to Shell’s update, the number of contractors and activity on site will be reduced after this pause, which will help the company control costs and plan the progression of the project. The company further stated that its Dutch subsidiary, Shell Nederland Raffinaderij B.V., will undertake an impairment review of this project and provide additional details in its Q2 update on July 5.

Year-to-date, Shell stock has gained over 13%.

Shell is a leading oil and gas company that provides a wide range of energy products, including fuels, oil, liquefied petroleum gas (LPG), and lubricants.

Shell’s Biofuels Aspirations Face Market Headwinds

The biofuel facility at the Shell Energy and Chemicals Park Rotterdam in the Netherlands is among the biggest biofuel plants in Europe, with a capacity of 820,000 tonnes a year. The facility was planned to produce sustainable aviation fuel and renewable diesel from waste and was expected to start in 2025, but it is already running behind schedule.

Meanwhile, the struggling biofuels market in Europe has made things more difficult for energy companies. Currently, the market is saturated with oversupply as more companies rush into this segment, despite lacking demand. Moreover, profit margins have been pressured by a significant decline in renewable fuel credit prices in the U.S.

In June, Shell’s rival BP PLC (GB:BP) also announced that it had cancelled the stand-alone biofuel production at its Cherry Point refinery in the U.S. and its Lingen plant in Germany.

Meanwhile, analyst Joshua Stone from UBS noted that this pause aligns with Shell’s strategy to focus on investor returns while reducing its climate change goals. Stone confirmed a Hold rating on SHEL stock yesterday, predicting a modest growth of 1.13%.

Is Shell Stock a Good Buy Now?

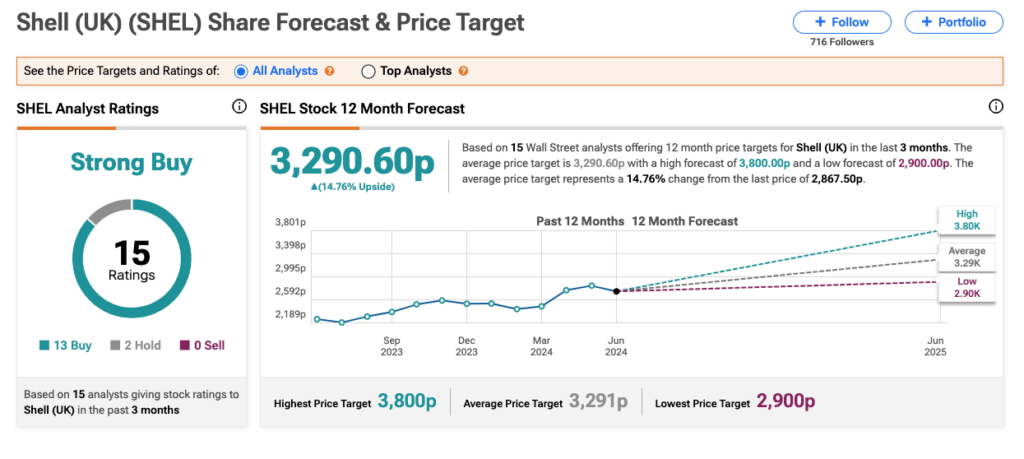

Overall, analysts hold a bullish stance on SHEL stock, as reflected in the Strong Buy rating on TipRanks. This is based on 13 Buy and two Hold recommendations. The Shell share price target of 3,290.60p implies a 15% increase on the current price level.