In major news on UK stocks, Prudential PLC (GB:PRU) delivered strong annual results for 2023. The company reported new business profits of $3.125 billion, marking a 45% increase on a constant currency basis from the previous period, surpassing the consensus of $2.9 billion. However, investors seemed unimpressed with the company’s performance. After initially opening higher, shares turned negative within a couple of hours and were trading down by about 6% as of writing.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Prudential PLC is an insurance company with a rich heritage in Britain. The company now primarily focuses on the markets of Asia and Africa.

Prudential Plc’s Impressive Results

Prudential’s adjusted operating profit grew by 8% on a constant currency basis to $2.9 billion, driven by solid execution in its key markets, Asia and Africa. The company’s APE (annual premium equivalent) new business sales increased by 37% in 2023 and continued its momentum in the first two months of 2024.

Hong Kong played a substantial role in driving growth, representing 45% of new business profits during the period. Both its new business profit and APE sales exceeded three times the previous year’s levels. The company expects continued growth prospects in Hong Kong, given the sustained demand from domestic consumers and visitors from Mainland China.

Between 2022 and 2027, Prudential aims to achieve a compound annual growth rate (CAGR) of 15%-20% in new business profits. Additionally, it is targeting a double-digit CAGR in operating free surplus generated from in-force insurance and asset management business over the same period.

Is Prudential a Good Stock to Buy Now?

Post-results, analyst Andrew Sinclair from Bank of America Securities confirmed a Buy rating on PRU stock, predicting an almost 60% upside.

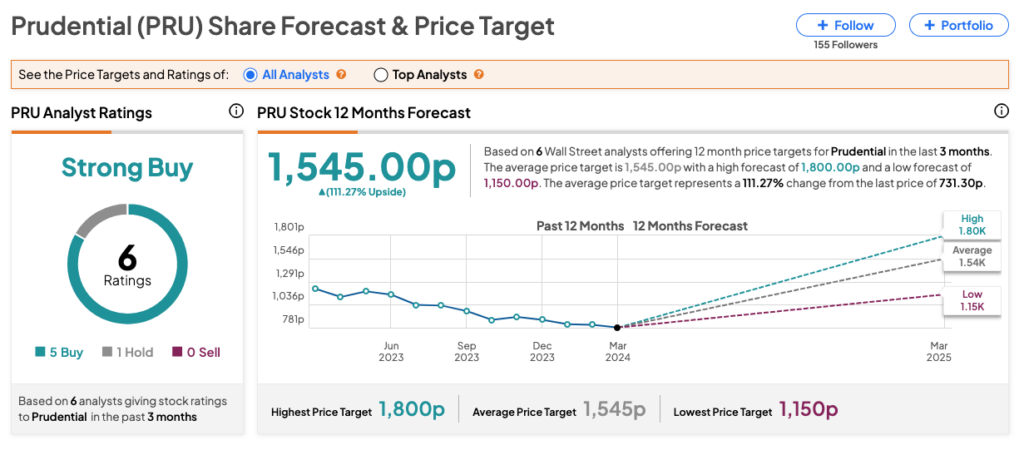

According to TipRanks, PRU stock has a Strong Buy consensus rating, backed by five Buys and one Hold recommendation. The Prudential share price target is 1,545p, which implies a huge upside of 111.3% from the current trading level.