In key news on UK stocks, Prudential PLC (GB:PRU) shares rose around 6%, as of writing, after the company launched a $2 billion share buyback programme to enhance shareholder returns. As part of this programme, the company announced its first tranche of $700 million, which will start immediately. By returning this capital to shareholders, the company aims to achieve its goal of reducing its issued share capital.

Year-to-date, Prudential shares have lost 13% in trading.

Prudential PLC specializes in life and health insurance, as well as asset management, with a primary focus on the Asian and African markets.

Prudential’s Enhanced Shareholder Returns

According to Prudential’s announcement, the buyback will be completed by mid-2026. The company also assured shareholders of further cash returns, considering its progress towards its 2027 financial objectives. The company is aiming for a CAGR (compound annual growth rate) of 15% to 20% in new-business profit from 2022 to 2027.

Furthermore, Prudential affirmed its commitment to consistency in its dividend policy and plans an increase of 7-9% in the 2024 annual dividend.

Following the reopening of the borders in 2023, the company witnessed strong growth in China and Hong Kong. In FY23, the company reported a substantial 45% year-over-year increase in its new business profit, reaching $3.1 billion.

Continuing its momentum, in the first quarter results for 2024, Prudential’s new business profits grew by 11% (excluding economic impacts) to $810 million compared to the prior corresponding period. Meanwhile, its APE (annual premium equivalent) sales rose by 7% in Q1 to $1.625 billion. The company added that its Q2 FY24 APE sales are in sync with the previous quarter’s performance.

Is Prudential PLC a Good Buy?

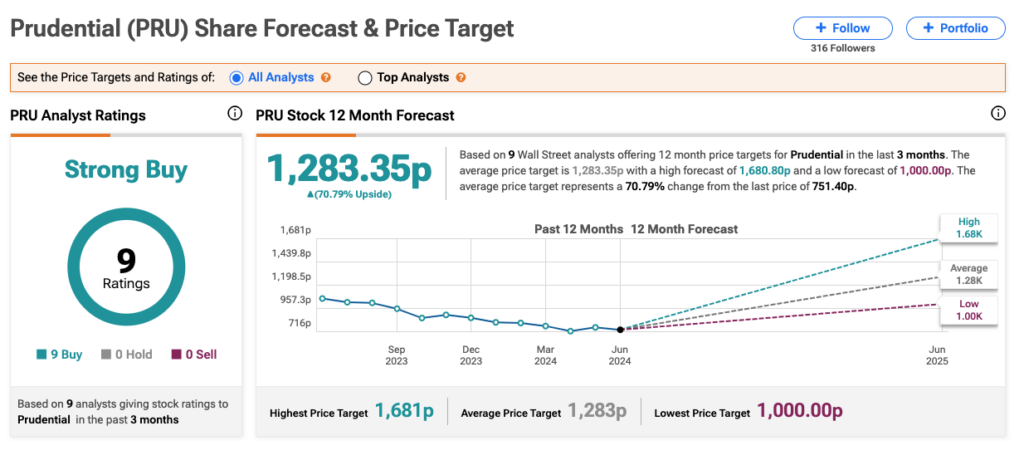

Following the buyback announcement, analyst Larissa Van Deventer from Barclays confirmed a Buy rating on the stock, predicting an 85% upside potential.

Meanwhile, Citi analysts have praised the buyback, which surpassed their expectation of $1 billion. Citi anticipates the buyback news to boost the share price, particularly amidst the current rough phase.

According to TipRanks, PRU stock has a Strong Buy rating, backed by Buy recommendations from all the nine analysts covering it. The Prudential share price target is 1,283.35p, which implies a huge upside of 71% from the current trading level.