Shares of the UK-based banking giant NatWest Group (GB:NWG) surged by over 6% as of writing after the bank upgraded its outlook for 2024, indicating confidence in its second-half performance. Along with its results, NatWest’s share momentum was also supported by the bank’s acquisition of UK-based smaller bank Metro Bank PLC (GB:MTRO).

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

NatWest is among the top four banks in the UK, catering to 19 million customers worldwide.

NatWest Expands Mortgage Assets

Natwest acquired €2.5 billion worth of UK prime residential mortgages from Metro Bank, adding approximately 10,000 customers. With this move, the bank aims to expand its Retail mortgage offerings within its risk parameters during a challenging period for mortgage business in the UK.

The company also mentioned that this deal builds on its latest acquisition of banking business from J Sainsbury PLC (GB:SBRY).

NatWest’s Upgraded Outlook

For the full year 2024, Natwest increased its forecast for return on tangible equity (ROTE) to over 14%, up from the previous estimate of 12%. Additionally, annual income is now expected to reach around £14 billion, higher than the earlier forecast of between £13 billion and £13.5 billion.

In the longer term, the group targets achieving a ROTE of more than 13% in 2026.

NatWest’s First Half Performance

In the first half, NatWest’s operating profit before tax fell by 15.6% to £3.02 billion compared to the same period last year. The decline was mainly attributed to fierce competition in the mortgage market and customers opting for higher-yielding products. Additionally, the bank’s profit attributable to its shareholders declined by 8.7% year-over-year to £2.1 billion.

However, the bank’s second-quarter performance offered some positivity. In Q2, operating profits grew by 27.7% quarter-over-quarter to £1.7 billion, while profit attributable to its shareholders increased by 28.6% to £1.2 billion.

The net interest margin (NIM) gained 5 basis points to 2.10% in Q2 2024 compared to the previous quarter, driven by higher deposit margins.

Are NatWest Shares a Buy?

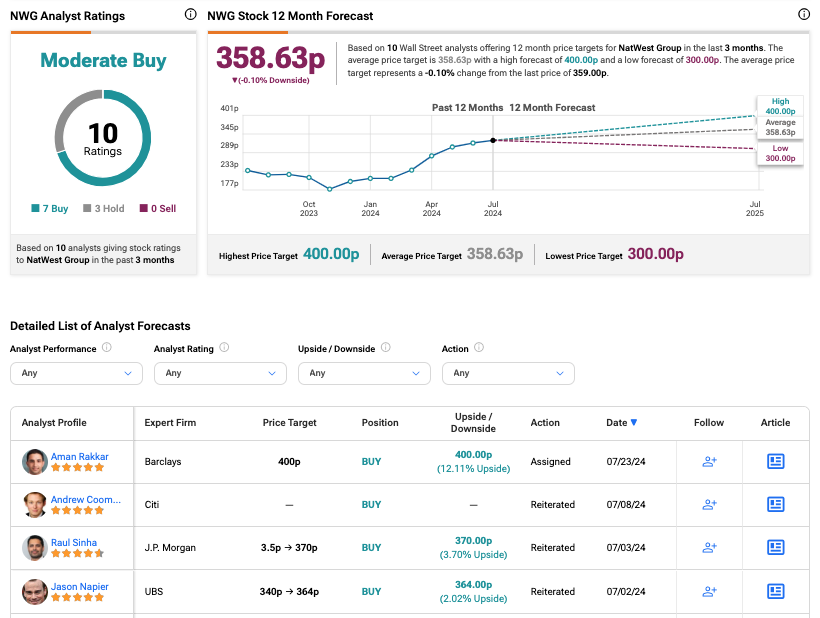

According to TipRanks, the NWG stock has a Moderate Buy rating based on 10 recommendations, including seven Buys. The NatWest share price forecast is 358.63p, which is almost similar to the current level.