In major news on UK stocks, JD Sports Fashion PLC (GB:JD) slumped by over 6% as of writing after the company’s annual results for FY24 disappointed investors. For the 52 weeks ending on February 3, 2024, JD Sports generated £10.4 billion in revenue, marking 2.7% year-over-year growth. However, profit before tax and adjustments dropped by 8% to £912.4 million, falling slightly below the company’s previously guided range of £915-£935 million.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Year-to-date, JD stock has declined by 25%, mainly triggered by a 23% drop on a single day in January in reaction to the company’s profit warning for FY24.

JD Sports Fashion is a retail company specializing in sportswear and fashionwear. Its product range includes international brands like Nike and Adidas as well as company-owned label brands.

JD Sports Maintains Profit Outlook

Despite the challenging trading conditions, JD Sports maintained its full-year profit before tax and adjusting items guidance of £955 million to £1.035 billion for FY25. Further, the company stated that its trading for 13 weeks in the first quarter of FY25 was in line with its expectations.

In Q1 2025, the LFL (like-for-like) sales decreased by 0.7%, compared to a strong 14.5% increase in the same period last year. Regionally, like-for-like sales decreased by 6.4% in the UK and by 0.1% in the Asia Pacific region but increased by 1.6% in Europe and by 2.0% in North America.

JD’s FY24 Results Summary

In FY24, like-for-like (LFL) sales increased by 3.8%, while organic sales grew by 9%. Among its regions, Asia Pacific revenue grew by 11.8%, while revenues for Europe surged by 26.9% during this period.

Within its segments, Premium Sports Fashion witnessed organic sales growth of about 11%. Premium Sports Fashion accounted for 81% of Sports Fashion revenue in FY24. However, operating profit before adjusting items for this sub-segment declined by 9.4%, hit by the majority of the company’s investment costs for future growth.

Speaking of shareholder returns, JD Sports announced a final dividend of 0.6p, resulting in total dividend of 0.9p per share in FY24. This marked a growth of 12.5% compared to the prior-year dividend.

Is JD Sports a Good Stock to Buy?

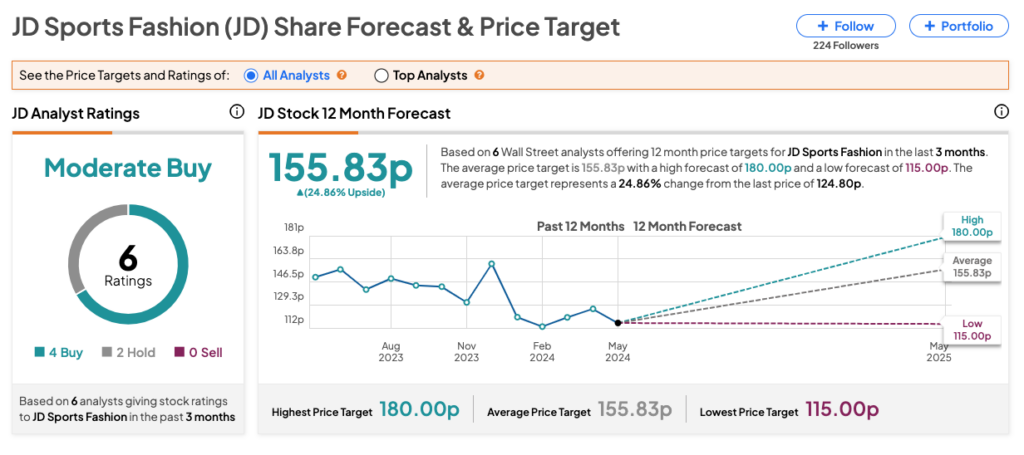

On TipRanks, JD stock has received a Moderate Buy consensus rating, backed by four Buy and two Hold recommendations from analysts. The JD Sports share price prediction is 155.83p, which is 25% higher than the current level.