In major news on UK stocks, Hargreaves Lansdown PLC (GB:HL) reported an 85% year-over-year surge in net new clients, reaching 24,000 in Q4. According to the company’s trading update, it now boasts 1.882 million active clients on its platform. Additionally, the company announced that it has extended the deadline for the second time for PE (private equity) firms to make a takeover offer. HL shares have gained 0.36% as of writing.

Hargreaves Lansdown is a renowned financial services firm known for its industry-leading investment platform.

Hargreaves Lansdown’s Q4 Performance

In the fourth quarter, Hargreaves Lansdown reported net new business of £1.6 billion for the period, in line with analysts’ forecasts. Meanwhile, its AUA (assets under administration) reached a record £155.3 billion, exceeding analysts’ expectations of £153.17 billion. The Q4 performance was mainly driven by positive momentum around the tax year end compared to the previous quarter. Additionally, more clients, higher share dealing volumes, and improved gross inflows further supported the quarter’s performance.

The share dealing volumes averaged 838,000 per month throughout the quarter, as compared to 685,000 in Q4 2023.

By the end of the quarter, the client cash balance stood at £12.4 billion, down from £13.1 billion in Q4 2023.

The company will publish its full-year results for FY24 on August 9.

Ongoing Takeover Discussions

Hargreaves Lansdown stated that its takeover discussion with a consortium led by CVC Capital Partners is still in process. The deadline has been extended from July 19 to August 5, providing more time for the companies to finalize details.

HL had earlier turned down a buyout offer of £4.67 billion, or 985p per share, from the consortium in May, arguing that it undervalued the company. In June, the company received a revised proposal of 1,140 pence per HL share in cash, including a 30p final dividend for FY24.

Is Hargreaves Lansdown Stock a Good Buy?

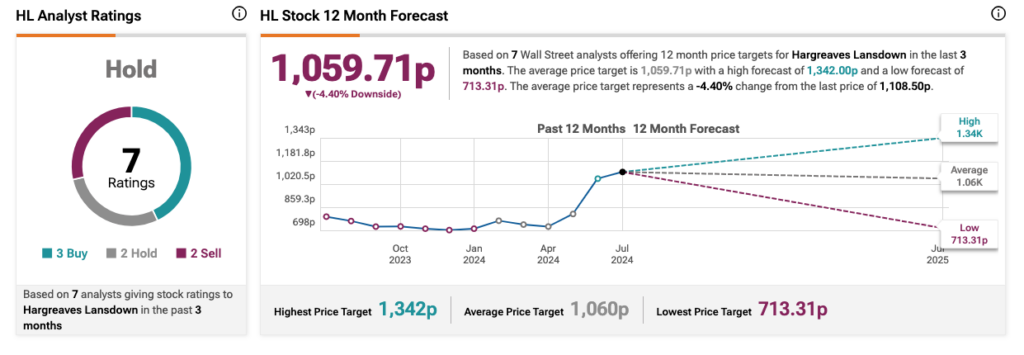

HL stock has been rated a Hold by analysts on TipRanks based on three Buy, two Sell, and two Hold recommendations. The Hargreaves Lansdown share price forecast is 1,059.71p, which is 4.4% lower than the current price level.