In interesting news on UK stocks, British miner Glencore PLC (GB:GLEN) is vying for the Singapore assets of energy giant Shell (GB:SHEL). A Reuters report suggests that Shell is on a hunt for suitable buyers for its oil refinery and petrochemical units in Singapore after earlier bidders opted out. Glencore has now emerged as a potential buyer, given that it has been interested in the assets since Shell put them on sale last June.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Based out of Switzerland, Glencore is a prominent player in the mining industry and a commodities trader known for the production of various metals and minerals, including copper, nickel, alumina, and iron ore. Meanwhile, Shell is a London-based multinational oil and gas company.

Here’s Why Glencore is Interested in Shell’s Assets

As per the report, the assets on sale include Shell’s refinery capable of processing 237,000 barrels per day (bpd) of oil and an ethylene plant located on Bukom island, just south of Singapore, as well as a mono-ethylene glycol plant on Jurong island in the west of Singapore.

Shell’s Bukom and Jurong assets will give Glencore a solid entry into Asia’s primary oil hub. Shell wants to sell these ageing assets since they have become less productive and uneconomical, especially for the production of petrochemicals. Plus, competition from newer players from China makes the products even less efficient.

Shell was in early talks with four players including the state-run China National Offshore Oil Corp (CNOOC), global energy trader Vitol, and private Chinese chemicals entities Eversun Holdings and Befar Group. The four were expected to make their formal offers by the end of February. Meanwhile, sources have revealed that China’s CNOOC and Befar have withdrawn their bids.

The potential bidders are hesitant to buy Shell’s Singaporean assets since the city is expected to impose a carbon tax soon, and the ageing assets run at high costs. Even so, Glencore’s heightened interest in buying these ageing assets displays the lucrative nature of the oil and gas industry.

Is Glencore a Good Stock to Buy?

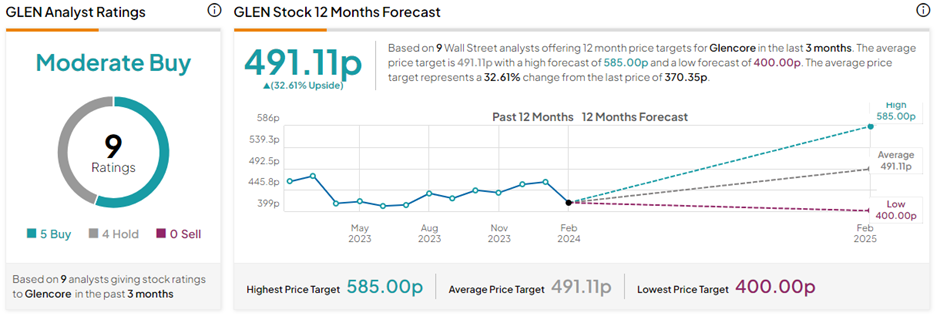

With five Buys versus four Hold ratings, GLEN stock has a Moderate Buy consensus rating on TipRanks. The Glencore PLC share price forecast of 491.11p implies 32.6% upside potential from current levels.