In key news on UK stocks, FTSE 250-listed easyJet PLC’s (GB:EZJ) winter losses narrowed by over £50 million year-over-year, driven by improved capacity on the back of growing demand. In its latest trading update, the airline announced an expected headline loss before tax of between £340 million and £360 million for the first half of FY24, compared to £392 million in the same period of FY23. Post-update, easyJet shares surged around 4% as of writing.

easyJet is a leading airline in Europe that operates in 34 countries and is known for its cost-effective services.

easyJet’s Positive Outlook After Strong Q2

In the first half, easyJet expanded its capacity by around 8% year-over-year to meet rising demand. The company’s revenue growth remained robust, growing 22% to £3.27 billion. Further, passenger numbers increased by 8% during this period.

Speaking of some headwinds, easyJet experienced higher fuel costs and growing tensions in the Middle East region, which impacted the company by around £40 million in the first half. The company also suspended its flights to Israel this summer.

However, the airline is looking at a strong summer season, driven by solid demand for its flights and holidays. easyJet Holidays has already sold 70% of its planned inventory for this summer and anticipates over 35% year-over-year customer growth for the full Fiscal 2024.

Additionally, third-quarter revenue is anticipated to see a slight increase year-over-year, boosted by the Easter peak in March. In the fourth quarter, revenue per seat is expected to maintain a considerable lead compared to the previous year, with approximately 30% of capacity already sold.

The company will publish its first-half results for FY24 on May 16.

Is easyJet a Good Stock to Buy?

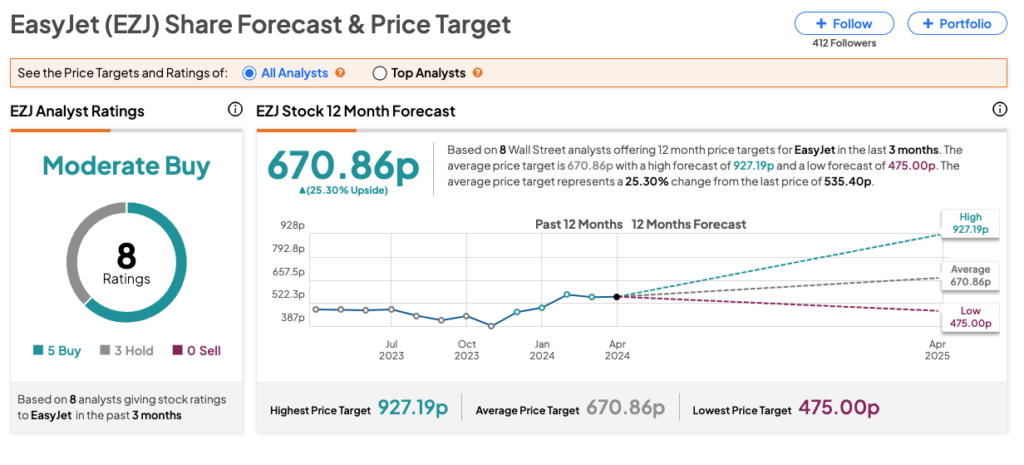

As per the consensus among analysts on TipRanks, EZJ stock has been assigned a Moderate Buy rating. The company’s ratings consist of five Buy and three Hold recommendations. The easyJet share price target is 670.86p, which implies an upside potential of 25.3% from the current levels.